Finding Your Path

Of Interest

By Lorne Polger, Senior Managing Director

Interest rates, and more specifically, their rapid rise, have been front and center in economic discussions now for almost two years.

The Federal Reserve Board began increasing rates in March 2022. Since then, the Fed has increased rates eleven times resulting in an increase of 5%. We’ve been sitting at the peak Federal Funds rate of 5.5% since July 2023.

The rapid rise in rates has caused a near paralysis in commercial real estate investment. According to CBRE, U.S. commercial real estate investment transaction volume was down 53% in the 12 months ended September 2023.

Interest rates need to be placed into a historical context to better understand where we’ve been and where we are likely going. Let us look at that data.

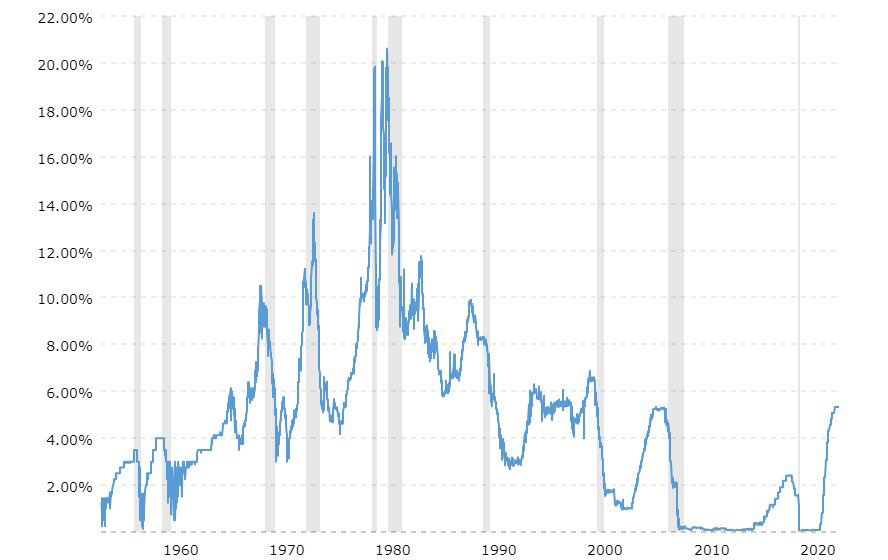

Federal Funds Rate - 62 Year Historical Chart

The chart below shows the daily level of the Federal Funds rate dating back to 1954. The Fed Funds rate is the interest rate at which depository institutions, like banks and credit unions, lend reserve balances to other depository institutions overnight, on an uncollateralized basis. The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. The Federal Funds rate is 5.33%. While this and other interest rates are substantially higher than their near-zero levels following the 2008 financial crisis and the pandemic, you would otherwise have to look to the 1950’s to find rates this low.

Notwithstanding the clamor surrounding higher rates, today’s rates look quite low in the context of history (rates were over 20% in 1979!). Rates were also higher in the late 1990’s than today.

In raising rates in the dramatic fashion that occurred from March 2022 to July 2023, the Fed sought to slow the economy down and reduce inflation back to an annualized rate of 2%. Inflation peaked at 9.1% back in June 2022, and dropped to 3.1% as of November 2023. It appears the Fed is tracking toward its goal and low unemployment suggests we may even have a “soft landing”.

Where Are Rates Heading?

A useful tool in predicting rate increases and decreases is the CME FedWatch. The Fed Funds rate is one of the most influential interest rates in the U.S. To hedge against potential changes in short-term interest rates, market participants turn to 30-day Fed Fund Futures contracts. These contracts are listed monthly. Using this information, CME Group created the FedWatch tool. It acts as a barometer for market participants to gauge the market’s expectation of potential changes to the target rate while assessing potential Fed movements around FOMC meetings.

The most current prediction indicates a 40.3% chance of a 25-basis point reduction and a 48.9% chance of a 50-basis point reduction by the May 1, 2024 meeting of the Fed. By the July 31, 2024, meeting, FedWatch predicts a 41.6% chance that we will be 75 basis points below our current rates and a 40.4% chance that we will be 100-basis points below.

Finally, by the end of next year, FedWatch predicts a 28.6% chance that we will be 125 basis points below today’s rates, a 36.3% chance that we will see a 150-basis point reduction and a 19.3% chance we will be 175 basis points below current rates. Rolling this all up, statisticians would say that FedWatch anticipates rates a year from now will be 138 basis points below today’s rates.

Finally, by the end of next year, FedWatch predicts a 28.6% chance that we will be 125 basis points below today’s rates, a 36.3% chance that we will see a 150-basis point reduction and a 19.3% chance we will be 175 basis points below current rates. Rolling this all up, statisticians would say that FedWatch anticipates rates a year from now will be 138 basis points below today’s rates.

Now the one thing about FedWatch is that their predictions are anything but static. The calculation changes weekly and is dependent on many factors. It does not, however, include the influence of geopolitical issues, consumer sentiments and similar related factors. That said, the unequivocal trend line is that meaningful rate reductions should occur this year.

Impacts on Lending.

As rates rose, commercial real estate lending fell. Debt coverage ratio tests became more difficult to achieve, especially in the climate of stagnant, or in some cases, declining operating revenues. In addition, the hardest hit sector (office) and the most speculative category (new construction) became persona non grata to banks, while alternative lenders saw their own credit facilities pulled or reduced, constraining their ability to lend. Debt leverage has historically been used by investors to increase returns. While rates rose, cap rates did not rise in lock step with them, so borrowers grew increasingly reluctant to invest, as the use of debt (in the form of negative leverage) drove down already marginal returns.

Looking forward to 2024 and 2025, I see us returning to a more normal environment. Over the past year, we’ve seen cap rates in our markets trend up, in some markets, quite significantly, as sellers were forced to acknowledge that buyers were no longer going to overpay for assets. Over the last quarter, we’ve tracked a number of apartment investments close at “neutral leverage”; i.e., where the cap rate was at or near the interest rate on the corresponding debt. From a lender’s perspective, neutral or positive leverage makes the credit decision much easier than a transaction with negative leverage. In the event cap rates stay near current levels (and historically, changes in cap rates have lagged changes in interest rates, both up and down), and rates fall, lenders should be able to make more loans, as they will be more comfortable with their credit decisions.

Looking forward to 2024 and 2025, I see us returning to a more normal environment. Over the past year, we’ve seen cap rates in our markets trend up, in some markets, quite significantly, as sellers were forced to acknowledge that buyers were no longer going to overpay for assets. Over the last quarter, we’ve tracked a number of apartment investments close at “neutral leverage”; i.e., where the cap rate was at or near the interest rate on the corresponding debt. From a lender’s perspective, neutral or positive leverage makes the credit decision much easier than a transaction with negative leverage. In the event cap rates stay near current levels (and historically, changes in cap rates have lagged changes in interest rates, both up and down), and rates fall, lenders should be able to make more loans, as they will be more comfortable with their credit decisions.

Impacts on Deposit Rates.

Money market and CD rates have been hovering around 5% since the middle of 2023. Short term treasuries peaked in the mid-5% range, and have slowly ratcheted down, but they remain elevated. The 6-month treasury yield now sits at about 5.25%, down from a peak of 5.6%. As the Fed reduces rates over the course of the next couple of years, the rates investors receive on treasuries and money market instruments will also fall. The high rates of return for sitting on cash led many investors to keep their money there instead of investing.

As yields on short-term cash fall back down into the 4% range, or, even lower, we would expect that investors will view holding cash as less attractive. In turn, this should stimulate more investment activity.

Impacts on Commercial Real Estate Investments.

We expect that commercial real estate investment activity will pick up throughout the coming year. Buying quality assets now below replacement cost with neutral or slightly positive debt leverage should prove to be a successful strategy, especially if you have the option to refinance in two or three years when rates should be significantly lower. The metrics of neutral or possibly positive debt leverage should increase investor confidence, and subsequently deal flow. The national brokerage firm Marcus & Millichap recently estimated that there is $300 billion of capital sitting on the sidelines waiting to pounce on opportunities. As rates start to head down, that capital will be put to work.

Predictions for 2024.

- Rates will fall in 2024 by 100-150 basis points.

- The reductions will not be significant enough to save many troubled real estate investments, especially given static income numbers.

- Investment activity will increase, especially in the second half of the year.

- 2024 will be an opportune time to purchase quality real estate assets, either all cash or with shorter term debt, and then refinance those assets in two or three years at lower rates.

One final prediction on the lighter side: There will be less snow than in 2023 but it really won’t matter that much if you enjoy skiing or boarding like I do. I hope that 2024 will be a healthy and prosperous year for you.

Lorne Polger is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Lorne was a partner with a leading San Diego law firm, where he headed the Real Estate, Land Use and Environmental Law group. He can be reached at lpolger@pathfinderfunds.com.

Share this Article