Guest Feature

Real Estate Reimagined: A Surge in Apartment Conversions

By Matt Quinn, Managing Director

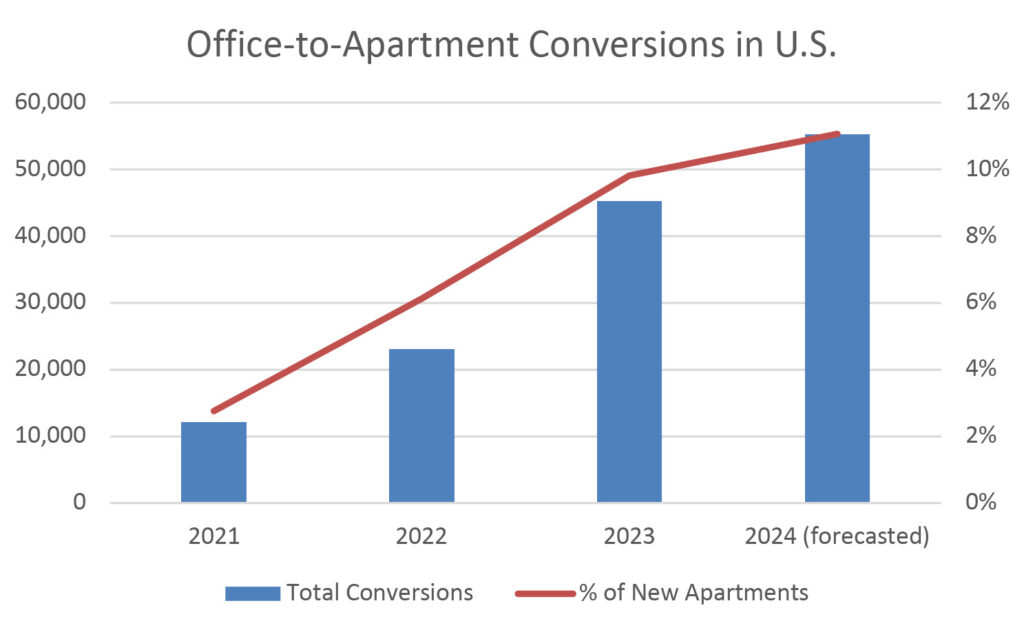

As a growing number of office buildings become obsolete due to remote work (the national vacancy rate is 18.8% and utilization is about half of pre-pandemic levels), a record number are being converted into apartments. In 2024, over 55,000 apartments are being constructed from office buildings, more than a 300% increase in three years and over 10% of the 500,000 new apartments expected in the U.S. this year. And the trend is forecasted to continue as cities confront rising office vacancies, reduced building values (and lower property tax rolls) and an ongoing housing shortage.

In many western U.S. markets where Pathfinder owns apartments, downtown central business districts remain challenged because of low office utilization rates several years after the end of the Pandemic. Downtown Seattle, Portland, San Fransisco and Los Angeles have been hit particularly hard. In St. Louis, entire sections of the City’s central business district are vacant and the AT&T tower, one of the region’s pre-eminent skyscrapers which sold for $205 million in 2006, recently sold for $3.6 million. These types of fire-sale transactions are resetting the cost bases for older office properties and helping facilitate conversions to apartments.

Washington D.C. and New York City are leading the nation with 5,820 and 5,215 conversion units underway, respectively. Since 1997, Metro Loft Management – one of New York City’s premier converters – has converted 5,000 apartments and business is booming. The company is converting Pfizer’s former NYC headquarters into 1,500 apartments, the largest such project in U.S. history, and the former J.P. Morgan headquarters into 1,300 apartments, the second largest. Local and state governments are supportive for various reasons, including rejuvenating struggling neighborhoods, increasing tax revenue and environmental benefits.

But converting an office building is easier said than done. A recent Rent Café study pegged the average age of converted offices at more than 70 years old and many are poorly lit, have low ceilings, massive mechanical systems and no outdoor spaces. Developers must be highly selective and choose buildings where conversion is relatively inexpensive or the location can justify higher costs. According to Gary London, a real estate consultant with San Diego-based London Moeder Advisors, “Only a small pool of obsolete office buildings are candidates for conversion, generally older buildings with smaller footprints. I fully expect to see an increase in demolition of obsolete office buildings that are not conversion candidates in the future”.

Coinciding with the decline of the office sector are sea changes in retail shopping – primarily, the massive shift to online shopping that has occurred over the past 25 years. This contributes to the decline in popularity of brick-and-mortar malls and strip centers. Retail centers often have advantages over office buildings as conversion candidates, including large parking lots and horizontal construction. There is an estimated one billion square feet of obsolete retail space in the U.S. and a recent study by Enterprise Community Centers reported that strip mall conversions could facilitate more than 700,000 housing units, a meaningful portion of the country’s 3- to 4 million-unit housing shortage.

Simon Property Group, an Indianapolis-based real estate developer, recently announced the planned conversion of an abandoned JCPenny in San Diego’s Fashion Valley Mall into 850 residential units. The conversion represents a major addition to San Diego’s housing stock, where only 4,000-5,000 units are built annually and large development sites are rare.

In California, where developable land can be scarce and expensive, there are 14,000 apartment conversion projects in the pipeline including 4,300 office-to-apartment and 3,800 hotel-to-apartment conversions. Hotel conversions are also growing rapidly. In 2023, hotel conversions accounted for 4,500 new apartments in the U.S., a 38% increase from the prior year and an all-time high. Hotels are generally easier and less expensive to convert because of their existing layouts and plumbing and electrical infrastructure. In New Orleans, the Kupperman Companies – a hotel owner/operator focused in the south – recently converted a Hilton Homewood Suites into an 86-unit, award-winning apartment complex. Like many conversions completed in the last few years, the hotel struggled during the Pandemic and was purchased at a steep discount. Because of the distressed sale and the property’s existing infrastructure, Kupperman was able to complete the conversion relatively inexpensively and could provide affordable rental rates. As a result, the redevelopment was the recipient of CoStar’s 2024 Impact Award for providing affordable housing to a community in need.

In California, where developable land can be scarce and expensive, there are 14,000 apartment conversion projects in the pipeline including 4,300 office-to-apartment and 3,800 hotel-to-apartment conversions. Hotel conversions are also growing rapidly. In 2023, hotel conversions accounted for 4,500 new apartments in the U.S., a 38% increase from the prior year and an all-time high. Hotels are generally easier and less expensive to convert because of their existing layouts and plumbing and electrical infrastructure. In New Orleans, the Kupperman Companies – a hotel owner/operator focused in the south – recently converted a Hilton Homewood Suites into an 86-unit, award-winning apartment complex. Like many conversions completed in the last few years, the hotel struggled during the Pandemic and was purchased at a steep discount. Because of the distressed sale and the property’s existing infrastructure, Kupperman was able to complete the conversion relatively inexpensively and could provide affordable rental rates. As a result, the redevelopment was the recipient of CoStar’s 2024 Impact Award for providing affordable housing to a community in need.

Neighborhoods with fledgling office or hotel districts are getting new life from apartment residents and retail centers, now vacant or struggling, are being transformed into apartment communities. And based on the size of the opportunity and the need for additional housing in the U.S., the trend to repurpose office buildings, retail malls/strip centers and hotels into apartments is expected to continue.

Matt Quinn is Managing Director at Pathfinder Partners, focusing on asset management activities. Prior to joining Pathfinder in 2009, Matt worked with a San Diego-based firm which consulted on mergers and acquisitions and with the Wealth Management division of a California regional bank. He can be reached at mquinn@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

Multifamily Opportunity / Value-Add Fund

CHARTING THE COURSE

What Schrödinger’s Cat Tells Us About Inflation and Interest Rates

FINDING YOUR PATH

Lessons from the WeWork Debacle

GUEST FEATURE

Real Estate Reimagined: A Surge in Apartment Conversions

ZEITGEIST

News Highlights

TRAILBLAZING

Accessory Dwelling Units

NOTABLES AND QUOTABLES

Opportunity