Guest Feature

Real Estate Investing Lessons Learned from a College Student, Ultramarathoner and Mike Tyson

By Jeff Wurtz, Chief Financial Officer

“Back to School!” Back-to-school feelings can vary quite a bit depending on whether you’re a student or a parent. As a student, heading back to school was often a downer with the return to a structured schedule. Transitioning from lazy days to a more regimented routine can be tough – not to mention the stress that comes with a surge in homework and activities, which can be overwhelming. But as a parent, back-to-school often brings a sense of relief in returning to a structured routine and having some quiet time during school hours.

It's been a few years since our kids were young enough to really wear us out during the summer, but the summer of 2024 was one for the record books in the Wurtz home. This summer included a college graduation, a wedding, moving the newlyweds to San Francisco, welcoming one son home from Italy then sending him back to college, and bringing another son home from college and then sending him off to Mexico. And just to keep things extra interesting at home, our youngest started driving – Oh Boy! I was ready for the normalcy a new school year would bring.

As exhausting as our summer was, it was also filled with wonderful discussions that lead to some great lessons – both personal and professional.

We are the Product of our Experiences

At one point this summer, my 21-year-old son asked me what I thought about him taking out a student loan to invest while in college (an idea shared with him by a friend). My initial thought was that he needs to find some new friends. But we explored the idea and had a conversation about the pros and cons, risks and rewards, if he chose that direction. As we talked, it was clear how little thought he had given to the potential downsides around the idea. I was talking to someone who had never experienced any sort of loss or negative financial outcome. He's not alone. We have a generation of college students and grads that had never known anything but financial increases – even through a worldwide pandemic.

We also discussed his budget for the school year, and I reminded him that I’m happy to be his backstop but not his bank – meaning I’ll keep him from ending up on the streets, but I have no intentions of funding his Chipotle and Jamba addictions. As a parent, I’m hopeful that he gets to experience what it feels like to get to the end of the month and realize he’s nearly out of money, has almost no gas in his tank, his friends invite him to do something, but he still needs to pay rent on the first of the month. Such situations provide opportunities to learn one of my favorite lessons – that we are the product of our experiences. As easy as it would be to be my son’s bank, doing so would shelter him from the low-stakes experiences in college that he will need later in life when the stakes of his decisions are much larger. Unfortunately, there’s no shortcut to experience. So, I hope he learns to like Ramen.

Many real estate investors and sponsors that cut their teeth in the real estate market following the Great Recession had, until 2022, never experienced a down market and knew nothing other than significant rent increases and property appreciation. With such a long stretch of “wins”, it’s no wonder many in the real estate world became overly optimistic about potential opportunities and the market as a whole. Their experience had produced a rose-colored-glasses view where everything looked great, challenges were minimal and potential issues ignored. Many of these people stretched their assumptions – and the prices they were willing to pay – and threw caution to the wind as they structured purchases several years ago using three-year, floating rate loans. The interest rates on those loans skyrocketed and the loans, now due, generally can’t be refinanced. (Like my son and his peers, these guys are now the product of their experiences.)

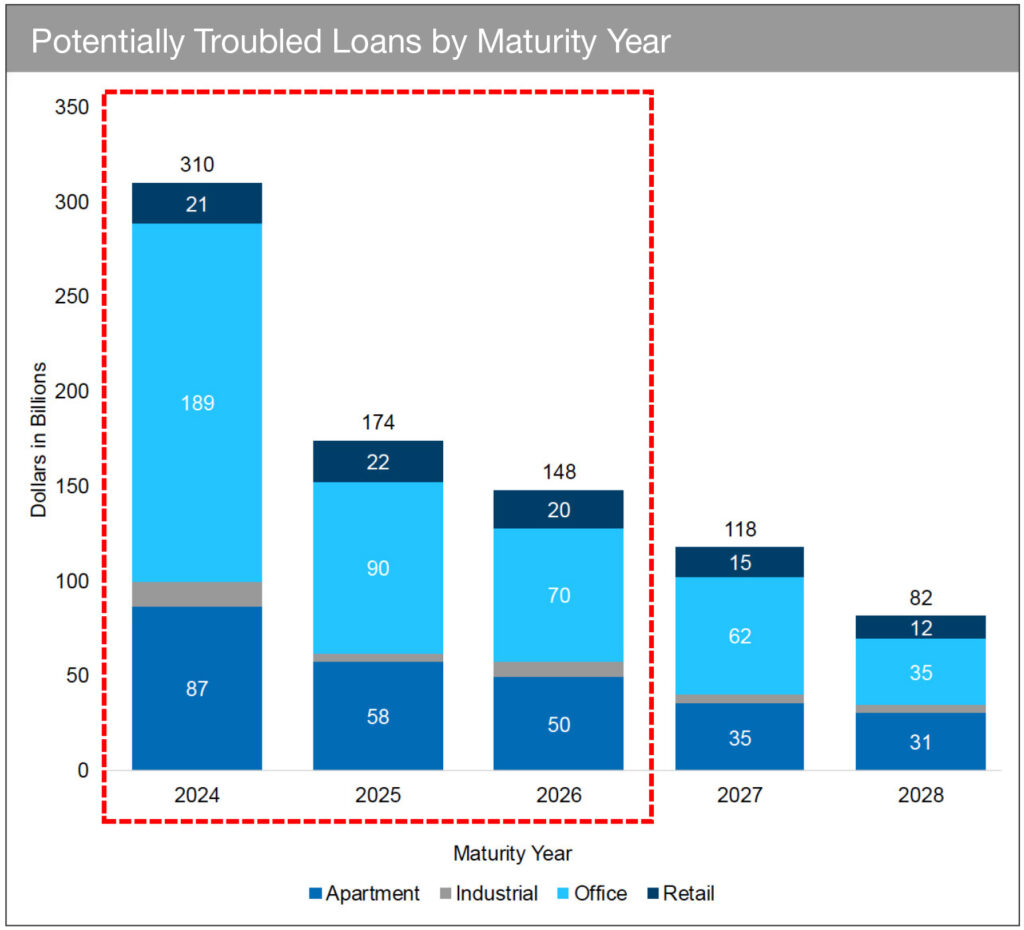

Today, we are seeing the fruits of decisions made when inexperienced people thought trees could grow to the sky. According to Newmark Research, $1.2 trillion of outstanding commercial real estate loans are potentially troubled (based on loan-to-value ratios), with $632 billion maturing between 2024 and 2026.

Many in the ranks of real estate investment firms with troubles in 2024 were the same groups which capitalized on low interest rates between 2020 and 2022, buying up thousands of apartments using floating-rate debt. They planned to renovate properties quickly and hike rents dramatically. But once interest rates soared, so did their monthly debt service.

Many in the ranks of real estate investment firms with troubles in 2024 were the same groups which capitalized on low interest rates between 2020 and 2022, buying up thousands of apartments using floating-rate debt. They planned to renovate properties quickly and hike rents dramatically. But once interest rates soared, so did their monthly debt service.

Skyrocketing operational expenses have also put downward pressure on income. Higher debt payments and lower income have produced big declines in debt service coverage ratios (DSCR), putting these borrowers into the “troubled” category with their lenders. About 78% had an operating DSCR lower than the one listed in their project underwriting, and 62% of all securitized real estate loans from the 2020-2022 period had a DSCR below 1.00 – a hallmark of a project not covering its expenses and debt service costs. Even factoring out current interest rates, which are likely higher than when the loan was first made, and nearly half – 46.4% – had net operating income below the underwriting assumptions from three years ago.

Some sponsors may be able to work with their lender on a modification, but most will not find the needed capital to work out a loan modification as investors are unwilling to put in good money after bad. The math doesn’t make sense based on the current values and equity requirements. And while interest rates are expected to start falling, it will be too little, too late for most of these sponsors as rates would need to fall 200-250 basis points to solve most of the problems for troubled operators – an unlikely scenario in the time frame needed. (A basis point is 1/100 of a percentage point.)

Unexpected Challenges lead to Unexpected Advantages for an Ultramarathoner

My daughter-in-law recently sent me an article about Cliff Young, who in 1983, at the age of age 61, became famous for his extraordinary performance in the Sydney to Melbourne Ultramarathon, a grueling 875-kilometer (545-mile) race. What makes the story even more amazing is that Cliff Young was a farmer, unlike the other entrants who were well known and proven ultrarunners – with some holding records and others bearing sponsorships.

My daughter-in-law recently sent me an article about Cliff Young, who in 1983, at the age of age 61, became famous for his extraordinary performance in the Sydney to Melbourne Ultramarathon, a grueling 875-kilometer (545-mile) race. What makes the story even more amazing is that Cliff Young was a farmer, unlike the other entrants who were well known and proven ultrarunners – with some holding records and others bearing sponsorships.

Despite his lack of experience and unconventional running style (developed from years of running after sheep on his farm), Young ultimately won the race, finishing in five days and 15 hours—beating the previous record by two full days. His entire story is amazing and there are several great lessons to be learned from Cliff’s experience, but what stood out most was that Cliff was successful because almost nothing went right for him the first day of the race - including following another runner off course and a team member setting an alarm for the wrong time. However, the unanticipated difficulties he experienced during the first part of the race worked together for his good as he discovered he was able to perform on less sleep and with less food than was the common wisdom of he peers. His resilient response to unexpected challenges led to unexpected advantages. Cliff Young’s success at the end of the race was a product of his earlier experiences.

The past five years have produced some of the most unexpected challenges to the real estate industry that could be imagined with a worldwide pandemic, unprecedented inflation and interest rate increases, social unrest in many urban markets and skyrocketing operating expenses. It’s safe to say that nobody underwrote all of those assumptions. However, those of us that made it through (for the most part unscathed) have become stronger because of it. We have learned to navigate areas like pandemic-era regulations and rising insurance expenses, created ancillary income streams to supplement income and sought efficiencies to offset higher costs from inflation. Like the story of Cliff Young, unexpected challenges have led to resilience and strength.

Closing Thought from Mike Tyson: Surviving First Contact

When Mike Tyson was asked by a reporter whether he was worried about Evander Holyfield and his fight plan he answered, “Everyone has a plan until they get punched in the mouth.” What Tyson said is like the old saying “no plan survives first contact with the enemy.”

Real estate is inherently cyclical and mounting evidence suggests the market is approaching a growth phase. The Pathfinder team’s experience in “surviving first contact” over decades of experience brings confidence as we deploy capital in the current opportunity-rich environment. We anticipate and accept that there will be challenges. We also understand that we are the product of our experiences and believe that those experiences provide us with unexpected advantages.

And while the kids moan about going back to school this fall, we on the other hand, look forward to the opportunities available during this next phase of the real estate investment cycle to those of us that have eaten Ramen, run the race before and survived first (and second, and third…) contact.

Jeff Wurtz is Chief Financial Officer of Pathfinder Partners. Prior to joining Pathfinder in 2012, Jeff worked as a CPA focused on real estate and technology clients. He can be reached at jwurtz@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

Multifamily Opportunity / Value-Add Fund

CHARTING THE COURSE

The Making of a Pathfinder Acquisition

FINDING YOUR PATH

Real Estate Quiz

GUEST FEATURE

Real Estate Investing Lessons Learned from a College Student, Ultramarathoner and Mike Tyson

ZEITGEIST

News Highlights

TRAILBLAZING

Internet as an Amenity

NOTABLES AND QUOTABLES

Patience