Finding Your Path

The Insurance Dilemma

By Lorne Polger, Senior Managing Director

Rising insurance costs for apartment owners have become a growing concern in recent years. Several factors contribute to this trend, which impacts both property owners and tenants.

Magnitude of Price Increases.

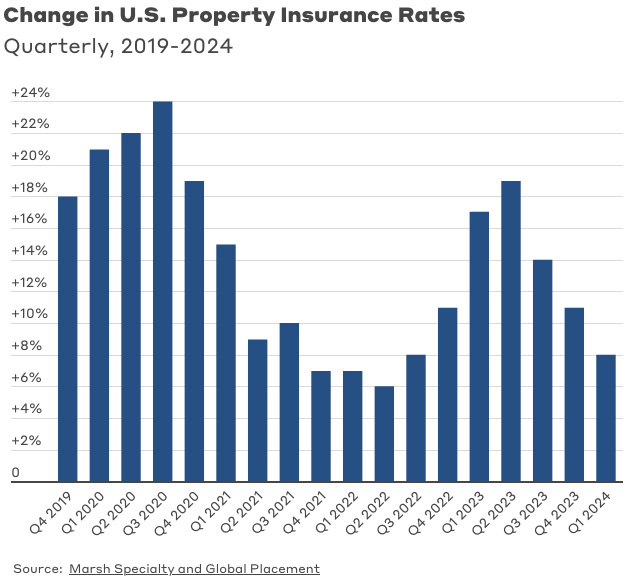

On average, commercial property insurance rates have increased by 5% to 15% per year over the last five years. A recent article in Bloomberg noted that insurance rates have risen for 23 consecutive quarters. Areas prone to hurricanes or wildfires have seen annual increases of 15% to 25%, with some carriers restricting coverage in extremely high-risk zones.

The COVID-19 pandemic and the resulting economic shifts led to significant premium increases from 2020 to 2021, especially as insurers faced uncertainties about business interruptions, claims, and future risks. By 2021, some industries saw premiums rise by 10% to 30%. In 2022, the commercial property insurance market remained tight, with rates climbing between 5% to 20% depending on the property’s risk profile. In 2023, the average increase slowed in some sectors but continued to rise for higher-risk properties. In that year, there were 28 natural disaster events in the U.S., each of which resulted in over $1 billion of direct costs to insurance carriers. Most recently, Globe Street reported that property insurance costs per unit rose an average of 27.7% year over year, and 129% nationally since 2018, according to a survey by Yardi Matrix.

There have been regional variations to the increases. Coastal properties, especially in states like Florida, Texas, and Louisiana, have seen dramatic increases, sometimes over 30% annually, due to the high frequency of catastrophic weather events. In areas prone to wildfires, such as California and parts of the Pacific Northwest, commercial property insurance premiums have increased by 20% to 40% or more in recent years. Finally, properties in flood zones have seen increased premiums as insurers tighten their coverage terms, reflecting the growing threat from climate change. Flood insurance premiums have risen by 15% to 25% annually.

Impact on Apartment Owners

For apartment owners and developers, these rising insurance premiums have had a significant impact on both short-term cash flow and long-term property values. Below are the key effects:

Increased Operating Costs. As insurance rates increase, the premiums that property owners must pay for coverage (such as property, liability, and casualty insurance) rise accordingly. This increases operating expenses and reduces cash flow. This is especially impactful for properties with thin profit margins or those not generating sufficient rent increases to offset the added expenses. Finally, higher insurance premiums reduce the Net Operating Income (NOI) –a key metric used to evaluate a property’s financial performance. A lower NOI can result in reduced property values and investor returns, making the investment less attractive to potential buyers or lenders.

Decreased Property Valuations. Commercial real estate investors typically use discounted cash flow (DCF) analysis or capitalization rate (cap rate) models to determine a property's value. Higher insurance costs reduce cash flow, which can lead to a lower valuation of the property, since lower income reduces future investor returns. As insurance premiums rise, investors may become more cautious in their valuation assumptions, potentially offering lower prices for properties with higher insurance costs or located in high-risk areas (e.g., flood zones, wildfire zones, etc.). This leads to downward pressure on property values in the market.

Effect on Financing. Lenders assess a property’s ability to meet its debt obligations through the Debt Service Coverage Ratio (DSCR), which compares income to debt payments. Rising insurance premiums increase operating costs, lowering the DSCR and making it harder to secure financing. This could result in more stringent lending conditions or higher interest rates for borrowers. Insurers may also require higher coverage levels for higher-risk properties, leading to higher insurance premiums, which can affect the Loan-to-Value (LTV) ratios that lenders are willing to accept. This may reduce the amount of financing available for investors, especially for properties in riskier locations. Developers may have received insurance quotes during the pre-development stage of a project that differ vastly from final quotes when they are ready to break ground. Those increases can have a dramatic impact on construction loan proceeds and ultimate project returns.

Changes in Rent and Lease Agreements. Property owners may attempt to pass increased insurance costs on to tenants by raising rents or incorporating pass-through clauses in leases. This strategy may be more feasible for properties in higher demand locations or where such pass throughs have become more commercially acceptable. However, tenants may be unwilling to accept rent increases if the market is soft or if there is a high supply of comparable properties. This could lead to higher vacancy rates or tenant turnover, particularly in less desirable locations.

Impact on Risk Management and Development Strategies. Rising insurance costs reflect higher perceived risks, such as those related to natural disasters, climate change, and geopolitical instability. As a result, property owners and developers may need to invest in risk mitigation strategies (e.g., improving structural resilience, flood defenses, or fireproofing).  While these measures can reduce insurance premiums in the long run, they represent additional upfront costs. Developers may scale back or delay new projects due to concerns over the rising costs of construction and insurance premiums. In some cases, the financial feasibility of certain developments may be negatively impacted if anticipated insurance costs significantly increase.

While these measures can reduce insurance premiums in the long run, they represent additional upfront costs. Developers may scale back or delay new projects due to concerns over the rising costs of construction and insurance premiums. In some cases, the financial feasibility of certain developments may be negatively impacted if anticipated insurance costs significantly increase.

Increased Focus on Environmental, Social, and Governance (ESG) Factors. As insurers increasingly assess properties for their exposure to climate risks (e.g., flooding, wildfires, extreme temperatures), commercial real estate investors may need to place greater emphasis on sustainable building practices. Properties that are not built or retrofitted to meet climate resilience standards may face higher premiums, which could impact their long-term viability and profitability. Investors may turn to green building certifications (e.g., LEED, BREEAM) and seek sustainability-focused property upgrades to reduce risks and potentially lower insurance premiums. Some insurance providers offer discounts for buildings with high sustainability ratings.

Long-Term Implications for Real Estate. If rising insurance premiums continue to increase due to factors like climate change and geopolitical risks, the commercial real estate market may experience long-term shifts. Investors might prioritize risk-mitigated, lower-exposure properties, leading to changing demand across different regions and sectors. Areas historically prone to natural disasters (e.g., coastal regions vulnerable to hurricanes or flood zones) may see a slowdown in investment due to the increasing cost of insurance. Conversely, markets that are seen as lower risk might attract more attention, especially if they have a combination of favorable insurance rates and strong economic fundamentals.

Pathfinder’s Risk Mitigation Strategies.

Given the rapid increases in insurance rates over the last few years, Pathfinder has used a multifaceted risk mitigation strategy. Some examples are noted below.

We conducted a request for proposals with several insurance brokerage firms in 2022 requesting creative strategies to help us reduce our premiums. The winning firm developed the best strategy and reduced our premiums, while maintaining similar coverage.

We also consolidated our insurance outside of higher risk Colorado from two carriers to one carrier and achieved economies of scale. Due to our larger size post-consolidation, we became a “key client” of the carrier, which helped our pricing. Following that consolidation, our asset management team met personally with the CEO of our primary carrier and created a relationship, which we leverage as needed. We are very careful about submitting claims – only when necessary for economic reasons – and work hard to promote a long-term relationship.

In Colorado, which is prone to wind/hail damage claims, we utilize a specialty carrier with a very competitive wind/hail deductible. We also installed impact resistant roof shingles at two of our Colorado properties.

In terms of other physical changes, we replaced aged Zinsco electrical subpanels at applicable properties due to their higher risk for fire, leveraged discounts at properties with central fire monitoring and utilize a live monitored A.I. security system at certain properties to deter crime and reduce corresponding claims.

When Can We Expect Insurance Costs to Decline?

Over the short-term, most analysts predict that commercial insurance rates will remain high for the next 12-18 months due to stubborn inflation, increased catastrophic risk and lack of competition. Over the long term, rates may begin to soften once the economic situation stabilizes (e.g., inflation slows, reinsurance costs normalize, and fewer major natural disasters occur). However, a rapid decline is unlikely, and any reductions are expected to be gradual.

Conclusions

Over the past five years, commercial property insurance rates have soared, with certain high-risk regions or sectors seeing annual increases of 30% or more. These increases reflect a combination of climate-related risks, higher construction costs, inflation, and shifts in the global insurance market. Rising insurance rates add significant pressure to the financial performance of commercial real estate investments. Higher premiums reduce profitability, devalue properties, and complicate financing. While investors may pass on some of these costs to tenants, market conditions may not always support such increases, leading to potentially higher vacancy rates. In the long term, the need for risk management strategies, increased sustainability, and smarter investment in resilient properties may become key strategies for coping with rising insurance costs.

While commercial insurance rates may stabilize or slightly decrease in certain locations over the next few years, significant reductions are not expected soon. Owners should monitor market trends closely and work with brokers to ensure they are getting the best value for their coverage.

Lorne Polger is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Lorne was a partner with a leading San Diego law firm, where he headed the Real Estate, Land Use and Environmental Law group. He can be reached at lpolger@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

Multifamily Opportunity / Value-Add Fund

CHARTING THE COURSE

Our Crystal Ball for Interest Rates Now More Opaque

FINDING YOUR PATH

The Insurance Dilemma

GUEST FEATURE

Are we on the Brink of a Rebound in the Multifamily Market?

ZEITGEIST

News Highlights

TRAILBLAZING

The AI Revolution in Apartments

NOTABLES AND QUOTABLES

Adaptation