Charting the Course

On Uncertainty, Geopolitics and Own Goals

By Mitch Siegler, Senior Managing Director

It’s been a topsy-turvy couple weeks of uncertainty and market gyrations, precipitated by on-again/off-again tariffs, bluster and braggadocio. Uncertainty hit a fever pitch on April 9th when President Trump announced he’d hit the pause button on most tariffs for 90 days. Whew! Doing so seems good both for the U.S. and the President’s political standing. (Growing fears of a trade war may explain why 53% of Americans disapprove of the President’s handling of the economy, according to RealClearPolitics’ polling average.) It sure is nice to see common sense win the day from time to time.

The first day of this latest roller-coaster ride was April 3rd, the day we held our annual meetings for a couple of hundred Pathfinder investors. This not being our first rodeo, the theme of our presentations was “uncertainty”, with economic headlines about tariffs, inflation and DOGE swirling in our heads. As we tried to read the tea leaves, our news feed was filled with stories about wars in Ukraine and Gaza and Chinese threats toward Taiwan along with developing challenges with Canada and Mexico – and Panama and Greenland.

The first day of this latest roller-coaster ride was April 3rd, the day we held our annual meetings for a couple of hundred Pathfinder investors. This not being our first rodeo, the theme of our presentations was “uncertainty”, with economic headlines about tariffs, inflation and DOGE swirling in our heads. As we tried to read the tea leaves, our news feed was filled with stories about wars in Ukraine and Gaza and Chinese threats toward Taiwan along with developing challenges with Canada and Mexico – and Panama and Greenland.

While we’re not in the predicting business – especially as to stock market performance – our investing radar was spinning with tariff talk in the days leading up to our meetings. We took comfort in the fact that our multifamily properties had occupancy levels above 95%, we collect 98% of rents and people need a place to rest their heads in good times and in bad. Oh, and apartments provide an outstanding hedge against inflation – should the Feds fail to slay that beast (or should tariffs or threats of them send prices spiraling). It’s gratifying that multifamily real estate is not highly correlated with traditional equity and fixed income markets so turmoil there doesn’t directly impact the apartment business.

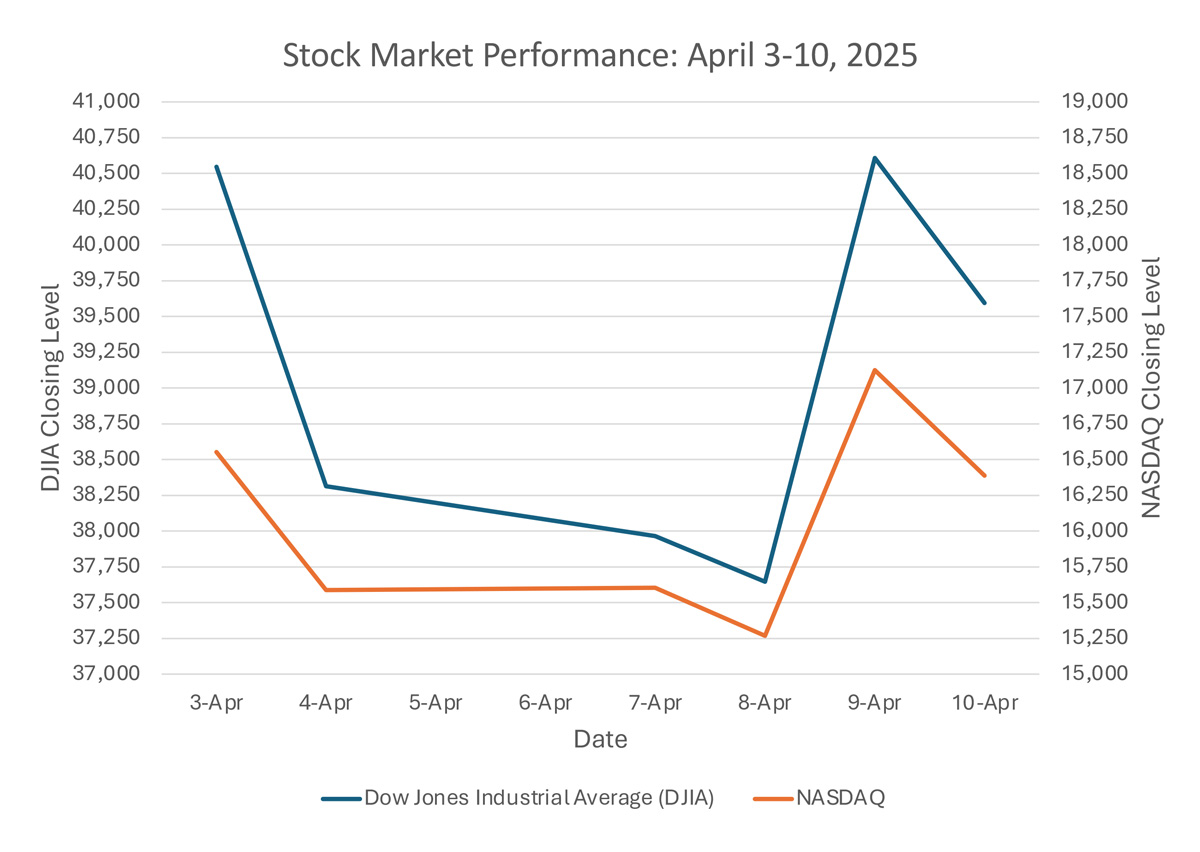

Back to the markets. The day of our meetings, the Dow Jones Industrial Average (DJIA) fell 4% and the technology-heavy NASDAQ index plummeted 6%. After the markets closed, China retaliated with tariffs of its own, leading to a further bloodbath the next day – the DJIA fell another 5.5% and the NASDAQ swooned by a further 5.8% on April 4th.

The roller-coaster ride continued the following week until President Trump announced on April 9th that tariffs would be paused for 90 days on all nations but China – propelling the markets upward, recouping a considerable portion of their recent losses. Although Treasury Secretary Bessent said placing, then removing, tariffs was the grand plan all along, that didn’t quite jive with the President’s explanation that he downshifted on most tariffs because people were getting “yippy” (we needed to consult Merriam-Webster for that one).

It’s still unclear whether the administration was playing checkers, chess, three-dimensional Vulcan chess or some other game. Maybe it’s all part of The Art of the Deal? We think more global trade is better, especially for the U.S. and maybe trade shouldn’t be viewed as a zero-sum game where the other guy must lose for us to win. People generally get the Law of Comparative Advantage, first set forth by Adam Smith in the 18th century: “If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of the produce of our own industry employed in a way in which we have some advantage.” Now, for those who get their philosophy elsewhere and folks who just aren’t big fans of Adam Smith, maybe this wisdom from boxer, Mike Tyson, is more your style: “Everyone has a plan until he gets punched in the face.”

Any way you slice it, it’s not unhealthy to see the administration respond to pressure and change course – that suggests a willingness to listen, generally a good thing.

Many analysts attribute the Trump tariff U-turn to pressure from the bond market. James Carville, political adviser to President Bill Clinton, famously said, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I would like to come back as the bond market – you can intimidate everybody.”

Of course, a lower level of chaos isn’t the same thing as calm. The 90-day pause on tariffs may have tamped down the uncertainty for a bit, but turmoil will likely return. The fundamental challenges are our trade deficits ($1.2 trillion in 2024, a record high), budget deficits ($1.3 trillion for the first half of fiscal year 2025 – with interest on the debt hitting a record) and national debt ($36.5 trillion as of March – the result of years of massive trade deficits with China and other countries, escalating entitlement spending and higher debt service costs).

These puzzle pieces – and others – fit together to tell a larger story. We couldn’t finance our trade deficits without buyers for our treasury bonds – and these buyers, many foreign, wouldn’t buy U.S. treasury securities unless the interest rates were sufficiently enticing. The fact that the U.S. dollar remains the world’s reserve currency doesn’t hurt – but that reserve currency status becomes harder to maintain when there’s fear about our balance of trade and deficits. Mix in volatile interest rates, uncertainty about economic growth rates and mixed signals from D.C. on fiscal and tax policy and it’s quite a stew of uncertainty.

Every headline could bring good or bad news – depending on where you sit. Falling oil prices – around $60/barrel at press-time – mean lower pump prices but also make it more difficult for U.S. oil producers to drill profitably. They also mean economic hardship for Russia and Iran, which have economies that are highly dependent on oil exports. We could do this sort of exercise for virtually every commodity, market, nation and industry.

Imagine how complicated it could get for the White House making deals – customized, bespoke deals (not those pesky off-the-rack deals) with 75 countries which are ostensibly lining up to make deals to stop the tariff pain. And these won’t be just deals about trade and tariffs. No Siree. These countries will be made to pay – for defense spending, mineral rights and more. Because the grand plan is to change the structure of the post-war order that benefits the U.S. and so many other countries in both economic and non-economic ways. Looking ahead, America will want to be paid for what it does for its allies around the world. This approach may be good, or it may be bad, time will tell on that, but if one thing’s certain, it’s that this approach is likely to create additional uncertainty.

Own Goals

In soccer, there’s nothing more painful than an “own goal”. That’s when one of your own players kicks, deflects or heads the soccer ball into your own team’s goal. Ouch – it’s bad enough when the opponents do that!

That – an own goal – is how economists and market pundits have characterized the recent tariff wars, which have turned allies into adversaries and wiped many billions in value from the market capitalizations of Apple, Microsoft, Tesla, Meta, WalMart, Starbucks, McDonald’s and more.

That – an own goal – is how economists and market pundits have characterized the recent tariff wars, which have turned allies into adversaries and wiped many billions in value from the market capitalizations of Apple, Microsoft, Tesla, Meta, WalMart, Starbucks, McDonald’s and more.

The U.S. can survive exports of cheap Chinese clothing and toys. China’s theft of U.S. intellectual property and dumping of steel and sophisticated manufactured goods – leading to the hollowing out of entire sectors of our manufacturing sector – are much greater threats. These decades-old practices are outrageous, and the President is right to call them out.

American automobile manufacturers should have free and fair access to markets around the world. U.S. companies should be able to compete on a level playing field and without having to give away their intellectual property. Those abuses simply can’t continue.

Markets rise and markets fall. Recently, the on-again/off again nature of the tariffs,the arbitrary nature of the tariff levels imposed– and the uncertainty this schizophrenia created – have been a major cause of market volatility. In periods of uncertainty, companies can’t plan, and they delay hiring and capital investment decisions. That happens in spades when tariffs – geopolitical uncertainty of the highest order – are slapped on friend and foe alike in a capricious manner. Now, the tariffs are affecting many nations, including our own.

Geopolitics are highly complex and investors fear what they don’t understand even more than what’s staring them in the face. Tariffs can morph into trade wars, which can turn into hot wars. Nobody wants that, so let’s hope this roller-coaster ride comes to an end soon.

Mitch Siegler is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Mitch founded and served as CEO of several companies and was a partner with an investment banking and venture capital firm. He can be reached at msiegler@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

CHARTING THE COURSE

On Uncertainty, Geopolitics and Own Goals

FINDING YOUR PATH

The Tariff Roller Coaster Ride. Hang On and Buckle Up Tight.

GUEST FEATURE

From Bricks to Clicks: What We Can Learn from the History of Apartment Tech

ZEITGEIST

News Highlights

TRAILBLAZING

Cedardale Apartments, Federal Way (Seattle), WA

NOTABLES AND QUOTABLES

Perseverance