Charting the Course

Our Crystal Ball for Interest Rates Now More Opaque

By Mitch Siegler, Senior Managing Director

As the year winds down, we often find ourselves taking stock of the economy. What seemed crystal clear this fall is a bit murkier today, so we turn to our old friend – perspective. Like a hiker in the forest who only sees trees, we need to scope out for a wider-angle view to see the forest and gauge how far we’ve come and assess what may lie ahead.

Interest rates are one of the most significant economic metrics affecting real estate, since borrowing costs have important implications for capitalization (“cap”) rates, a key determinant of property values. Interest rates also send important signals about inflation, a key determinant of future apartment rent growth. If these factors are healthy, there is likely to be meaningful property transaction (purchase and sale) activity. If they’re not, not so much.

Only in the past few months has Pathfinder begun acquiring properties again, after a more than two-year hiatus. Nothing made much sense to us from spring-2022 to summer-2024, so our acquisitions team took a breather. Overall real estate transaction volumes during this period were also down dramatically, around 75% from peak levels. The root cause: the rapid and dramatic rise in interest rates.

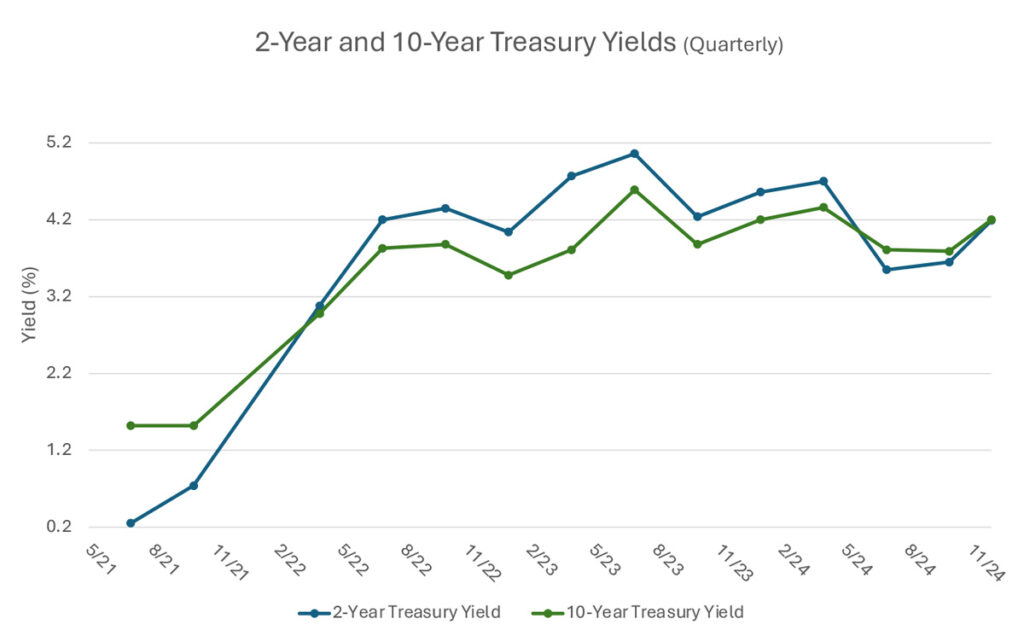

Three years ago, short-term interest rates (measured by the 2-year treasury rate) were well below long-term interest rates (measured by the 10-year treasury rate). In early November 2021, the “10-year/2-year spread” was 1.24% (the 10-year was 1.65% and the 2-year was 0.41%). That dynamic – where investors demand a duration premium in the form of higher interest rates for tying up their money for longer – is the typical state of markets. (Today, the spread is only about 0.05%.)

The past few years, though, have been anything but typical. As interest rates rose from late 2021 through late 2022, rates on both 2-year and 10-year bonds jumped. The rate on the 2-year treasury jumped from 0.41% to around 4.0% in 2022 (hovering around this level for much of 2022). The 2-year has held steady since – it’s around 4.15% at press-time.

During the same period, the 10-year treasury also rose to around 4.0%. But since its starting level was four times that of the 2-year treasury, its rise was less in both relative and absolute terms. And, during 2022, the rate for the 2-year treasury exceeded the rate for the 10-year, obliterating that typical duration premium for investors who hold longer-term bonds. This phenomenon – an “inverted” yield curve – signaled that longer-term rates were likely to fall over time, suggesting lower inflation. (An inverted yield curve is also associated with a slowing economy.)

The fall 2024 interest rate “inflection point”

Since the Federal Reserve’s (Fed’s) first rate cut in two-and-a-half years this September, a 50- basis point decline, investors have been focused on the futures markets, which have been signaling meaningful declines in the Federal Funds rate (the key benchmark interest rate set by the Fed) through 2025. The CME Fedwatch Tool, based on futures market data, had been projecting that the Fed could reduce the Fed Funds rate by 1.75% from September 2024 to December 2025. This suggested that the Fed Funds rate before the September rate cut (5.25%) could fall to around 3.50% by late 2025. The Fed’s second rate cut, 25 basis points in November, continued this downward trend. (A basis point is 1/100 of a percentage point.)

That’s around the time things began to go cattywampus. The presidential election results surprised a couple of people and a few more took notice when the Senate flipped from blue to red and the House stayed in Republican hands, signaling a strong hand for the incoming administration and the President-elect’s party.

That’s about where any clarity ends. Already, economists, investors and market pundits are questioning whether the new administration’s proposed tariffs could trigger another bout of inflation, whether increased federal spending could propel deficits and what higher levels of government borrowing could mean for interest rates. (Spoiler alert: there’s a lot more chatter around rates remaining higher or not falling as quickly as the consensus believed even a few weeks earlier.)

The election has clouded Fed watchers’ crystal balls

Many political pundits peg the impact from high inflation following the Biden administration’s spending after the pandemic as a primary driver of the 2024 presidential election results. While it’s true that inflation has fallen dramatically from its peak of 9% in 2022 to around 2.5% today, the damage – in the form of higher prices – was done to consumer pocketbooks. That contributed to a majority of American voters sending the party in power packing because of high grocery and gas prices and higher borrowing costs on mortgage, auto and credit card loans.

The next chapter in the inflation story will be told based on whether inflation can wend its way to the Fed’s 2.0% target. That will largely be a function of economic growth, labor market trends (including the supply of labor – driven, in part, by immigration), housing costs (including mortgage rates and rent growth (expected to rebound in 12-18 months because of falling supply of new apartments). Many other factors – like the impact of Artificial Intelligence on productivity and demand for labor – are also in the mix and the number of people with great conviction about where everything will shake out are few and far between.

Investor expectations

Since markets look ahead in anticipation, investor inflation expectations – driven by concerns about deficit spending and the rates the U.S. government will need to pay to borrow ever increasing sums – will also play an important role in the inflation/interest rate story. Related questions – like “How much of the Biden administration’s Inflation Reduction Act will survive past Inauguration Day?”, “What will be the impact of tax cuts?” and “What happens if there is a resurgence in inflation?” – will also play a part.

Current projections from Fed officials suggest a more moderate glidepath for interest rates, with Fed governors signaling that they expect rates will fall 0.75 to 1.25 percentage points during the next year (from 4.50% now to 3.25% to 3.75% by late 2025.

Current projections from Fed officials suggest a more moderate glidepath for interest rates, with Fed governors signaling that they expect rates will fall 0.75 to 1.25 percentage points during the next year (from 4.50% now to 3.25% to 3.75% by late 2025.

Today, even this more cautious bet is not for the faint of heart. In mid-November, Fed chair Powell said, “The economy is not sending any signals that we need to be in a hurry to lower rates.” Accompanying September retail sales data, which came in stronger than analysts’ expectations, provided further support for an economy that may not need more Fed stimulus. (September’s retail sales growth was revised sharply upward from expectations of 0.4% to 0.8%.) The same day, data on auto purchases climbed at the fastest rate in three months and restaurant sales have now risen for seven straight months, suggesting that household discretionary spending is plenty strong.

Remember that CME Fedwatch Tool, which predicts the future of interest rates? A month ago, it was pegging the odds of a December rate cut at 86%. After Fed Chair Powell’s mid-November statement and the stronger than expected consumer spending data, those odds had fallen to 58%.

The lessons of the pandemic, the 2024 elections and the geopolitical turmoil we’ve seen the past few years have cemented for many of us the sense that there’s no knowing what tomorrow will bring. The future course of interest rates is no different. We’re reminded of Mark Twain’s famous quote: “It ain't what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Mitch Siegler is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Mitch founded and served as CEO of several companies and was a partner with an investment banking and venture capital firm. He can be reached at msiegler@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

Multifamily Opportunity / Value-Add Fund

CHARTING THE COURSE

Our Crystal Ball for Interest Rates Now More Opaque

FINDING YOUR PATH

The Insurance Dilemma

GUEST FEATURE

Are we on the Brink of a Rebound in the Multifamily Market?

ZEITGEIST

News Highlights

TRAILBLAZING

The AI Revolution in Apartments

NOTABLES AND QUOTABLES

Adaptation