Charting the Course

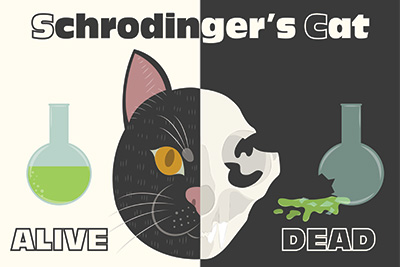

What Schrödinger’s Cat Tells Us About Inflation and Interest Rates

By Mitch Siegler, Senior Managing Director

Schrödinger’s cat is a thought experiment in physics which imagines a cat inside a steel box alongside a flask of poison and a radioactive material connected to a Geiger counter. If the Geiger counter detects even an atom of the radioactive material decaying, the flask is shattered, releasing the poison, killing the cat. If not, the cat lives out the balance of his nine lives. Since no one knows precisely what is happening inside the steel box, physicists must treat the cat as both dead and alive at the same time.

In a sense, the U.S. Federal Reserve (“Fed”) operates in a similar fashion and economists and investors are left guessing about what’s happening. Like the cat, which may be alive and dead at the same time, inflation may be cooling and overheated simultaneously. On the one hand, there are signs pointing to cooling inflation, leading many to conclude that interest rate cuts are just over the horizon. On the other hand, inflation remains too high and Fed pronouncements about upcoming interest rate reductions are sketchy. Pundits are puzzled by statements that make the Fed seem bilingual in English – various statements and pronouncements can make inflation seem both overheated and benign concurrently.

That may explain some Fed flip-flopping on rate cuts, which many had previously expected to begin in early 2024. Mixed signals on inflation have caused the Fed to hold rates steady this year and the Fed’s current body English suggests that meaningful third quarter rate cuts aren’t in the cards, as the inflation picture remains opaque and because of political concerns about rate cuts just prior to a presidential election. Smart money is now betting on two rate cuts in the fourth quarter of 2024 (maybe preceded by a small cut in September) and accelerating in 2025.

That may explain some Fed flip-flopping on rate cuts, which many had previously expected to begin in early 2024. Mixed signals on inflation have caused the Fed to hold rates steady this year and the Fed’s current body English suggests that meaningful third quarter rate cuts aren’t in the cards, as the inflation picture remains opaque and because of political concerns about rate cuts just prior to a presidential election. Smart money is now betting on two rate cuts in the fourth quarter of 2024 (maybe preceded by a small cut in September) and accelerating in 2025.

Economics: It Ain’t What it Used to be

Forty years ago, when I first studied economics, the basic principles felt straightforward. Plotting supply and demand curves helped us understand the direction of prices – higher if demand exceeds supply, or lower if supply pressures were greater. The Phillips curve was a simple tool to demonstrate tradeoffs between inflation and employment – one rises while the other falls.

Today, we are bombarded with amorphous economic concepts like modern monetary theory (“MMT”), which postulates that government spending and taxation should be used to achieve full employment and price stability, irrespective of where we are in an economic cycle, and that government deficits don’t have consequences. While the effect of unlimited spending on individual or household budgets is clear, MMT proponents are convinced that prudent household budgeting is unnecessary at the macroeconomic (governmental or societal) level – and spending more than you have won’t materially affect inflation or the prices consumers pay. Some politicians are particularly taken with MMT since more spending appeals to more interest groups leading to more votes. Count us among the skeptics as to the prudence of such approaches or the negligible impact on prices and inflation from spending whatever the heck you want irrespective of your income or savings.

A View to Economic Growth in the Second Half of the Year

In a May interview, Ellen Zentner, Morgan Stanley’s Chief U.S. Economist, set forth the firm’s view on the economic outlook for the second half of 2024. In Morgan Stanley’s base case, the U.S. economy is forecast to remain strong, but U.S. gross domestic product (economic) growth is slowing, from 3.1% in the fourth quarter of 2023, to 2.1% in the fourth quarter of 2024 and into 2025. Decent growth still, but certainly slowing.

Morgan Stanley attributes the continued economic growth to increased immigration driving population growth, which will continue to expand the labor supply and support the economy, without increasing inflation. While the labor market during the pandemic was characterized by persistent labor shortages, the availability of labor is now increasing, and could outstrip demand this year. The firm believes this will boost the unemployment rate from 3.7% at the end of 2023 to 4.2% at the end of 2024, and to 4.5% in 2025.

Because immigration and population growth boost the labor supply, Morgan Stanley expects slower wage gains as unemployment rises. That will crimp consumer spending in 2024 and into 2025 as a cooling labor market weighs on growth in real disposable income and elevated interest rates keep borrowing costs high.

Tighter Lending Standards

We’re seeing the effect of tighter lending standards on credit availability all around us. Defaults on automobile loans increased 13% from March 2023 to March 2024. That’s the highest level in 30 years, according to Fitch. Credit card loan defaults have jumped 50% from 2023 to 2024, according to the New York Fed. You may be insulated, dear readers, but the data shows that ordinary Americans are feeling the pinch of higher inflation and interest rates and a slowing economy.

Real estate investors are feeling the impact of tighter lending standards, too. Many of those who acquired properties at the recent peak a couple of years ago used higher cost, higher leverage loans to finance their purchases. Those were the only loans they could find which would support those late-cycle acquisitions. Many of these loans were floating rate (adjustable) and shorter-term in nature (often three years). About $500 billion of such loans are maturing in 2024-2025 in the multifamily space alone. The situation for office loans is even uglier. Many of these borrowers will have no choice but to sell their properties, often for 25% to 30% below what they paid, wiping out their equity. We launched Pathfinder Multifamily Opportunity Fund IX, L.P. this spring to capitalize on the opportunity. Let us know if you’d like to participate in the Fund IX initial closing at the end of June.

Real estate investors are feeling the impact of tighter lending standards, too. Many of those who acquired properties at the recent peak a couple of years ago used higher cost, higher leverage loans to finance their purchases. Those were the only loans they could find which would support those late-cycle acquisitions. Many of these loans were floating rate (adjustable) and shorter-term in nature (often three years). About $500 billion of such loans are maturing in 2024-2025 in the multifamily space alone. The situation for office loans is even uglier. Many of these borrowers will have no choice but to sell their properties, often for 25% to 30% below what they paid, wiping out their equity. We launched Pathfinder Multifamily Opportunity Fund IX, L.P. this spring to capitalize on the opportunity. Let us know if you’d like to participate in the Fund IX initial closing at the end of June.

What’s Ahead for Interest Rates?

We agree with Morgan Stanley that lower rates are on the horizon, which should boost housing demand and spending on household goods in mid-2025. We’re heartened by the April data, which shows prices for rents, goods, and services decelerating.

The Fed has held the policy rate steady in the 5.25% to 5.50% range since July 2023. Morgan Stanley expects the Fed to deliver the first 0.25% rate cut this September. In total, Morgan Stanley expects 0.75% rate cuts this year, and another 1.00% in cuts by mid-2025. That would lower the Fed Funds rate to around 4.5% by December and to about 3.5% by the end of 2025.

But even before rate cuts, the Fed has announced it will start phasing out Quantitative Tightening (“QT”) in June. Morgan Stanley expects QT to end entirely around March 2025, when the Fed's balance sheet is a little above $3 trillion. Reduced QT should be stimulative to the economy, like interest rate cuts.

So, is inflation cooling or still too high? Is the cat alive or dead? The picture ought to become clearer in the months ahead.

Mitch Siegler is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Mitch founded and served as CEO of several companies and was a partner with an investment banking and venture capital firm. He can be reached at msiegler@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

Multifamily Opportunity / Value-Add Fund

CHARTING THE COURSE

What Schrödinger’s Cat Tells Us About Inflation and Interest Rates

FINDING YOUR PATH

Lessons from the WeWork Debacle

GUEST FEATURE

Real Estate Reimagined: A Surge in Apartment Conversions

ZEITGEIST

News Highlights

TRAILBLAZING

Accessory Dwelling Units

NOTABLES AND QUOTABLES

Opportunity