Charting the Course

Strong Tailwinds Should Propel Multifamily

By Mitch Siegler, Senior Managing Director

2022 was a terrible, horrible, downright lousy year for stock and bond investors. The S&P 500 lost 19.6%, the NASDAQ lost 25.0% and even fixed income investors lost money (-13.4% for investors in the U.S. Bond Aggregate/Bloomberg index).

Amidst this carnage, investors in Pathfinder’s Income Fund saw their investment grow in value by 16% (realized and unrealized returns) in 2022. Tumult in traditional equity and fixed markets and recent bank failures create turbulence for markets and investors, including multifamily investors. However, the multifamily sector has strong underlying fundamentals, which create powerful tailwinds and support for the sector.

Four Tailwinds Supporting the Multifamily Sector

- Underlying fundamentals strong: Supply/Demand imbalance remains in place.

The supply of new housing has not kept pace with population growth and new household formation (demand) for decades. This lack of new supply is particularly acute in cities with limited land availability and a challenging entitlement/permitting climate. Many of these cities are also characterized by high home prices, increasing the propensity to rent, further boosting demand.

In our primary markets (Seattle, Portland, Sacramento, San Diego, Phoenix and Denver), occupancy levels have hovered at or above 95% for years. That doesn’t leave much slack since residents are always moving in or out and some units are not immediately rent-ready because they’re being renovated or prepared for lease. Think about 95% occupancy as essentially fully occupied. If a developer decides today to build a new apartment project on a vacant parcel, the time to entitle the land, obtain the building permits and construct the buildings is typically five years. It takes a long time for supply to adjust and in many cities where we operate, the shortage of housing is acute and years (or decades) in the making. Bringing the conversation full circle, more demand than supply leads to high occupancy rates and strong rent growth.

In our primary markets (Seattle, Portland, Sacramento, San Diego, Phoenix and Denver), occupancy levels have hovered at or above 95% for years. That doesn’t leave much slack since residents are always moving in or out and some units are not immediately rent-ready because they’re being renovated or prepared for lease. Think about 95% occupancy as essentially fully occupied. If a developer decides today to build a new apartment project on a vacant parcel, the time to entitle the land, obtain the building permits and construct the buildings is typically five years. It takes a long time for supply to adjust and in many cities where we operate, the shortage of housing is acute and years (or decades) in the making. Bringing the conversation full circle, more demand than supply leads to high occupancy rates and strong rent growth.

- Workforce housing provides good value and is a sweet spot in the apartment sector.

Multifamily housing is something of an investment safe harbor because everyone needs a place to rest his head. Older, workforce (Class-B) apartments are a superior value to newer, Class-A properties and far less expensive than homeownership. Our properties are typically suburban and older (generally ‘80s-and ‘90s-vintage) with renovated kitchens and bathrooms. The commute is a bit further and the properties aren’t brand new but they’re spacious, clean and fresh and the rents are much lower.

If we have a “hard landing” (today’s more palatable phrase for “economic recession”), Class-A apartments, with their higher rents, could come under pressure and discounted rents or concessions could be commonplace. Workforce housing, on the other hand, should be more insulated and continue to outperform.

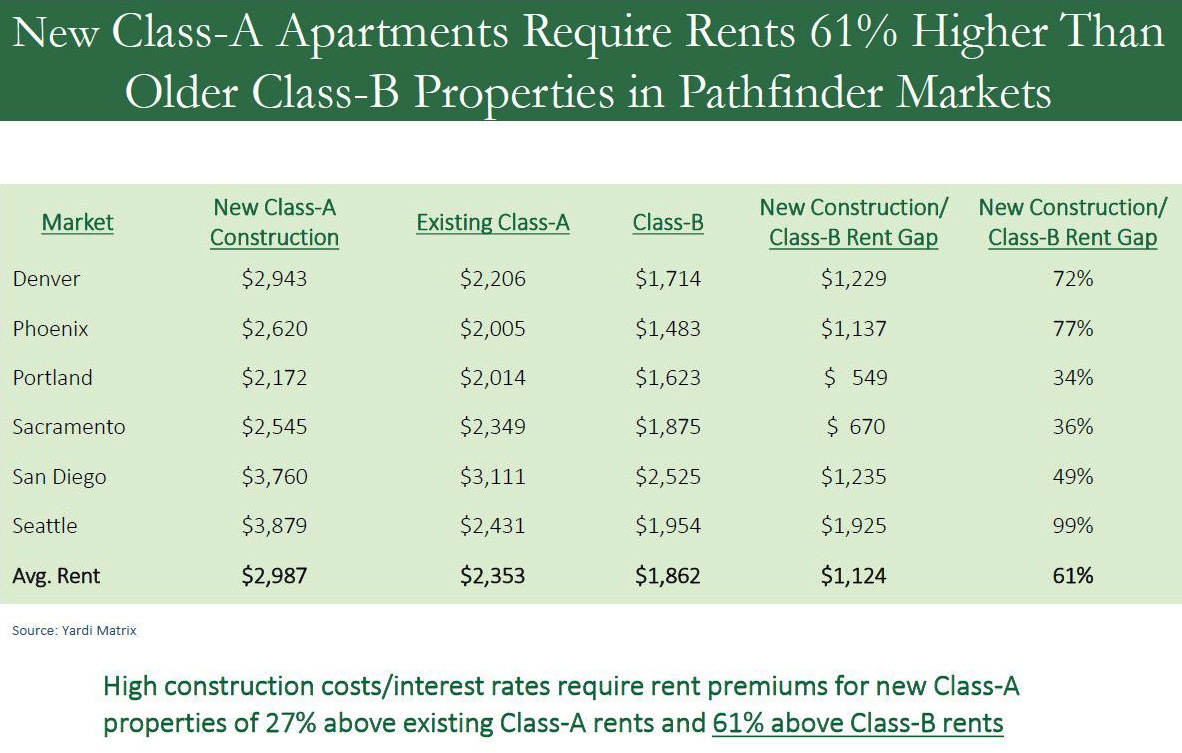

Rents in Class-A apartments (often located downtown and offering fancy swimming pools and exercise rooms) are typically 25-35% more expensive than in our suburban, Class-B properties. Rents in brand new apartments? Fuhgeddaboudit. Our research suggests that rents for a new, Class-A apartment are 61% higher than in a typical Pathfinder workforce housing (Class-B) apartment in our western U.S. markets.

Homeownership is a housing option that’s even further out of reach for many residents of the six western U.S. cities where Pathfinder owns apartments. For those who can cobble together a down payment to buy a home in Seattle or San Diego (no easy feat in markets where median home prices are $780,000 and $880,000, respectively), the monthly cost of homeownership is $2,486-$2,689 more than renting, per Yardi Matrix. Home prices in Portland, Sacramento and Denver are a bit less expensive but the monthly gap in those cities is still $1,400-$1,500. Phoenix is a relative bargain, just $900 more to own than rent each month but that’s in a city with meaningfully lower income levels. You get the idea – with high home prices and mortgage rates which have doubled in the past year, it’s far cheaper to rent than to own.

- Apartment rent growth has been a solid inflation hedge for years. Property appreciation also produces investment returns, further hedging inflation. While rent growth has cooled, it remains at or above historical levels.

We’ve long said that multifamily housing – particularly workforce housing in resilient, suburban markets – is a solid inflation hedge. That’s because leases reset every year compared with leases in office or retail properties, which typically have terms of five to ten years. Hedging against inflation wasn’t a major consideration for most of this millennium but that’s changed big-time as inflation began accelerating in 2021.

For 20 years, from 2001-2020, inflation averaged 2.1%. During the same period, multifamily rents grew 2.6%. While there was some variability during periods of higher and lower inflation and external events, like the 2008 Financial Crisis and the pandemic created short-term swings, apartments have proven to be a very strong hedge against inflation.

For 14 years prior to the pandemic (2007-2020), rent growth in Pathfinder’s markets averaged 4.6%. The pandemic upset the apple cart; rent growth in our markets skyrocketed to an average of 13.2% in 2021-2022. We’ve long said that this was an aberration and double-digit rent growth would not be sustained. Looking ahead three years (2023-2025), forecasted rent growth in our markets is 3.6% – near the 14-year average prior to the pandemic.

- Some economies are more resilient than others.

We saw this clearly during the pandemic. When offices closed and many worked from home, cities with strong technology industries fared well. Economies with strong government employment sectors remained healthy while those dependent on tourism or heavy manufacturing struggled. For years, young people have migrated to areas with strong software, life sciences and health care economies – since these sectors frequently thrive in cities with outstanding universities – which tend to be in communities with robust arts and culture scenes. It’s no surprise that apartment economics are healthier in more resilient communities.

Near-Term Turbulence Creates a Few Headwinds.

Anyone with a home mortgage or auto or credit card loan knows that interest rates have risen dramatically and quickly. Interest rate volatility has also led to several recent bank failures, which have been all over the news. Also in the news are stories about rent control initiatives in several cities and states and potential “Tenants’ Bill of Rights” initiatives nationally. This turbulence creates headwinds for multifamily investors.

Anyone with a home mortgage or auto or credit card loan knows that interest rates have risen dramatically and quickly. Interest rate volatility has also led to several recent bank failures, which have been all over the news. Also in the news are stories about rent control initiatives in several cities and states and potential “Tenants’ Bill of Rights” initiatives nationally. This turbulence creates headwinds for multifamily investors.

- Investment sales markets are frozen.

In efficient markets, sellers and buyers meet to find the clearing price. Brokers and other intermediaries bring the parties together. Today, property owners have little motivation to sell since they’re looking in the rearview mirror at the prices they might have obtained a year ago. Buyers are looking through the windshield and fear slower economic growth or a possible recession. Broker friends, whose transaction volumes are down as much as 75% year-over-year, say it’s a great time to go skiing and hope that won’t be the story next winter/spring as well.

- Higher interest rates make underwriting acquisitions challenging today.

We haven’t acquired or sold a property since May 2022. For the same reasons homebuying activity has slowed as mortgage rates rose from about 3% in spring 2022 to 6% today, multifamily buyers are challenged to find acquisitions that make sense in a world of higher interest rates. Many multifamily property owners don’t even think about selling today since they know buyer interest will be muted and pricing won’t be as attractive as it was a year ago when capitalization (cap) rates were lower. Other factors – including buyer and seller psychology, a more constrained lending environment and tax considerations – also come into play but it’s primarily a story of interest rates exceeding cap rates.

- Recent bank failures have heightened market volatility.

Over the past month, the failures of Silicon Valley Bank (SVB), Signature Bank and Credit Suisse were front page news stories. While banks generally have much healthier loan books today than in the lead-up to the 2008 Great Financial Crisis, it’s the part of the iceberg that’s hidden below the water’s surface that you really need to worry about. In the case of SVB, the issue was a mismatch in terms: liabilities (bank deposits) had 90-day, 30-day or just 1-day durations while assets (the bank’s holdings of treasury bonds) had five- and ten-year durations. The speed with which these institutions suffered runs on the bank and the slipshod nature of management controls and regulatory oversight spooked investors.

There could be more shoes to drop in the banking arena. Small and mid-sized (regional) banks own more than half of commercial real estate (CRE) loans. Meanwhile, many shorter-term CRE loans made in 2021-2022 mature in 2024 and the refinancing environment then may be challenging. That’s particularly true for challenged asset classes like office buildings. For a variety of reasons, these regional banks may not want to add to their CRE loan books and it’s an open question which lenders will step into the breech and what rates and terms may look like next year. Stay tuned to see how all of this plays out.

There could be more shoes to drop in the banking arena. Small and mid-sized (regional) banks own more than half of commercial real estate (CRE) loans. Meanwhile, many shorter-term CRE loans made in 2021-2022 mature in 2024 and the refinancing environment then may be challenging. That’s particularly true for challenged asset classes like office buildings. For a variety of reasons, these regional banks may not want to add to their CRE loan books and it’s an open question which lenders will step into the breech and what rates and terms may look like next year. Stay tuned to see how all of this plays out.

- Heightened regulatory concerns.

While onerous rent control legislation has been enacted in just a handful of cities (New York, San Francisco and parts of Los Angeles, most famously), there are concerns that other areas could follow suit. And there is uncertainty about Federal initiatives – like the proposed “Tenant’s Bill of Rights”. Investors dislike uncertainty and the political uncertainty swirling around regulations is not for the faint of heart.

The answer to housing shortages is more housing. Those cities which look for easy answers – and rent control regulations are the ultimate “knee-jerk” reaction to systemic issues of poor zoning and land use regulations and out of control NIMBYism – will suffer as developers build elsewhere and housing stocks in regulated markets deteriorate further.

Much has been written about increased apartment supplies. But don’t expect this year’s higher apartment deliveries to alter the supply/demand imbalance.

Apartment deliveries have increased but we think it’s a blip that likely won’t be sustained.

For the past 50 years, annual apartment deliveries have averaged 360,000. In 2023 and 2024 they’re projected to be 25% higher – 440,000 and 460,000, respectively. Viewed through a wide-angle lens, you’ll see that apartment deliveries were substantially higher in the 1980s and even in the 1960s – on a much smaller population base. Guess when the last time more than 400,000 apartments were delivered: That was 1972 when there 125 million fewer Americans. Today’s “higher” deliveries don’t keep up with what’s needed for today’s larger population or reflect the cyclical increase in rental demand (because of high home prices and mortgage interest rates).

And we expect apartment deliveries in 2024-2025 to fall. That’s because many “planned” projects won’t be constructed anytime soon because of rising construction costs and higher interest rates. Many developers who own and entitle land still won’t break ground on most projects because today’s economics don’t pencil for them to do so.

We’ve all experienced a few minutes of turbulence on otherwise pleasant cross-country flights. That’s how we view the current moment for multifamily investors. If you put your seat belt on, you should be just fine.

Mitch Siegler is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Mitch founded and served as CEO of several companies and was a partner with an investment banking and venture capital firm. He can be reached at msiegler@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER PARTNERS INCOME FUND, L.P.

A Stablized Multifamily Fund

CHARTING THE COURSE

Strong Tailwinds Should Propel Multifamily

FINDING YOUR PATH

Rocky Mountain High

GUEST FEATURE

When You Evaluate Investment Returns, also Consider Risk

ZEITGEIST

News Highlights

TRAILBLAZING

Passage, Vancouver (Portland Metro), WA

NOTABLES AND QUOTABLES

Staying the Course