Charting the Course

Dazed and Confused

By Mitch Siegler, Senior Managing Director

No, we’re not talking about the 1993 stoner film – or even about cryptocurrencies, NFT’s or the metaverse – all of which make our eyes glaze over.

Mixed signals abound. Federal Reserve Chair Jerome Powell doesn’t talk much anymore about a “soft landing,” an economic slowdown which slows inflation without causing a big increase in unemployment. Half of Americans surveyed think the U.S. is already in a recession and last week’s 75-basis point increase in interest rates is virtually assured to further depress the already stagnant housing market and slow bank lending – among the casualties in the Fed’s war on inflation. (A basis point is 1/100 of a percentage point.)

Also making our heads spin are the wild twists and turns in markets this spring and summer. The past few weeks have been brutal for equity markets; the S&P 500 is officially in bear market territory, down 24% year to date. It’s not lost on investors that September and October are historically difficult months for equities so the recent downdraft and volatility could be just the warm-up act.

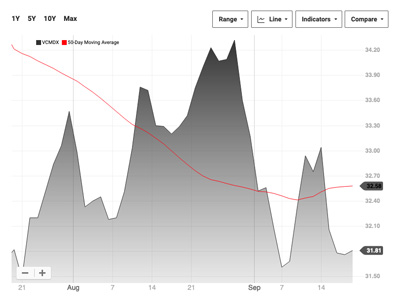

The bond market has not exactly offered investors a warm, gentle aromatherapy bath. The yield on the ten-year treasury note has skyrocketed nearly 80% from 1.87% on March 1 to 3.93% now. Investors in 30-year treasury bonds, long believed to be a safe haven investment, have had their worst year in decades. The VIX, which measures volatility, has whipsawed from 37 in March to 18 in April before settling at about 30 now (after retesting the lows again in August). And if you’re not completely baffled, check out this roller-coaster-shaped chart for the Vanguard Commodity Strategy Fund during the past year.

“We might experience a little turbulence,” says the soft-spoken, 30-year airline pilot, who learned how to stay calm under pressure flying fighter jets. While relieved to hear a steady voice, seasoned travelers might still be just a wee bit nervous. That’s kind of how experienced investors likely feel. Here are a couple of other things that have us scratching our heads this summer.

Exhibit “A”, public equities – The market for initial public offerings has been frozen solid for months; it’s a very short list of companies which have gone public this year. Meanwhile, a quite well-financed, publicly traded technology company we know well has a current market capitalization about a third below the value of the cash on its balance sheet. And this company has blue-chip financial backers, no debt, highly innovative technology (for which investors give it not one penny of value) and a several-year cash runway. Hmmm.

Exhibit “B”, the venture capital sector – Several private companies we’ve invested in personally have very short cash runways and need to raise capital, like yesterday. The companies’ lead investors are AWOL for one reason or another. In a couple of cases, the old fund which made the original investment is fully deployed and there’s no new fund today. In another case, the lead investor has several “problem children” in their portfolio and limited bandwidth for care and feeding – or discipline – depending on their parenting style. So, a new lead investor can set fresh terms, which represent ‘burn-out’ valuations a fraction of previous values. And the companies have arguably progressed meaningfully toward technical and/or sales milestones since the prior financing rounds. Hmmm.

Exhibit “B”, the venture capital sector – Several private companies we’ve invested in personally have very short cash runways and need to raise capital, like yesterday. The companies’ lead investors are AWOL for one reason or another. In a couple of cases, the old fund which made the original investment is fully deployed and there’s no new fund today. In another case, the lead investor has several “problem children” in their portfolio and limited bandwidth for care and feeding – or discipline – depending on their parenting style. So, a new lead investor can set fresh terms, which represent ‘burn-out’ valuations a fraction of previous values. And the companies have arguably progressed meaningfully toward technical and/or sales milestones since the prior financing rounds. Hmmm.

Other head-scratchers revolve around when inflation will cool, when supply chain issues will resolve and if we’ll have a recession, stagflation, or something else. It’s apparent that the unprecedented government spending these past two-and-a-half years is still winding its way through the financial system and continuing to stoke inflation. We believe the Fed was caught rather flat-footed from spring 2021 until its first rate hike this past March. To preserve its reputation, we expect the Fed to err on the side of squelching inflation – the economy be damned. If we must have a recession for Fed governors to sleep well knowing they tamped down inflation, so be it. Until the Fed can really get a grip on price stability and investors can truly wrap their heads around whether we’re heading for a soft landing or something else entirely, the turbulence is likely to continue.

Experiencing Labor Pains?

Turbulence aside, there was much for the Fed to like about the August jobs report, published the Friday before Labor Day. There were 315,000 net jobs, fewer than in July. Wage growth also slowed. Unemployment ticked up to 3.7% as more people entered the workforce. So, the Fed’s alchemy – five interest rate rises in the past six months – seems to be bringing about its desired effect, dampening economic growth. Slower growth is the Fed’s medicine for high inflation so what’s not to like?

Well, for starters, the Fed seems to be fighting the last war in the way it measures unemployment. You see, our unemployment measures were designed to track people who were unemployed because they couldn’t find jobs. The issue today is that millions of people are unemployed because they choose to not be employed.

Well, for starters, the Fed seems to be fighting the last war in the way it measures unemployment. You see, our unemployment measures were designed to track people who were unemployed because they couldn’t find jobs. The issue today is that millions of people are unemployed because they choose to not be employed.

You’ve heard the overused phrase “The Great Resignation”. Millions of Americans have dropped out of the workforce. It’s why so many jobs remain unfilled, restaurants continue to be short-staffed, construction projects are taking longer than planned, driving up costs, and tech companies struggle to hire the engineers they need.

Economist Nick Eberstadt, who wrote “Men Without Work”, says four times as many Americans withdrew from the workforce since the start of the pandemic than are technically unemployed – so looking at the official unemployment rate misses four-fifths of the iceberg. Of course, this phenomenon didn’t just start yesterday – it’s been occurring for decades at a smaller scale but was turbocharged during the pandemic.

Here’s the math: There are 11.2 million job openings in a market with six million unemployed workers to fill them. That’s nearly two jobs for every person seeking one 30 months after the onset of the pandemic. This is feeling like a more permanent challenge with implications for economic growth, productivity, inflation, and society at large.

Sure, some of this is a mismatch of skills but much of it isn’t – millions of able-bodied workers have withdrawn from the labor force. The Kansas City Fed estimates that 2.1 million “excess” retirements – those above the historical trend line – occurred during the pandemic. And as more Americans stay home because of long Covid, to care for an ailing parent or for other reasons, the labor-force participation rate has fallen from 63.4% prior to the pandemic to 62.4% in August. While that doesn’t sound like a massive shift, it’s millions of workers. And get this: the Labor Department forecasts further declines to 60.4% by 2030 – that’s several million more workers on the sidelines!

The labor shortage could get worse, and the problem could persist for many years. Today, labor markets are being squeezed by a sharp fall-off in legal immigration, especially in important sectors like science, technology, engineering, and mathematics (STEM). Job postings for hardware and software engineers are up more than 80% since February 2020. The Labor Department expects a shortfall of more than a million STEM workers by 2030. And each STEM job drives economic growth that translates into another 2.5 jobs, so this is a very big deal.

We always like to close on a happy note. As temperatures fall and the leaves begin to change, we hope interest rate increases are closer to the end than the beginning, inflation is finally cooling, supply chain shortages are beginning to ease and labor markets will soon return to equilibrium. Surely, that’s not too much to ask for?

Mitch Siegler is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Mitch founded and served as CEO of several companies and was a partner with an investment banking and venture capital firm. He can be reached at msiegler@pathfinderfunds.com.

IN THIS ISSUE

PATHFINDER PARTNERS INCOME FUND, L.P.

A Stablized Multifamily Fund

CHARTING THE COURSE

Dazed and Confused

FINDING YOUR PATH

A Bumpy Ride Ahead for Housing

POINT/COUNTERPOINT

The Death of Office Space?

The Future of OfficeZEITGEIST

Sign of the Times

TRAILBLAZING

East of Eleven, Portland, OR

NOTABLES AND QUOTABLES

Humility

![]() Check out these recent podcasts

Check out these recent podcasts

Pathfinder’s Mitch Siegler was recently a featured guest on the Street Smart Success with Roger Becker Podcast Episode 217, 50% of Americans Are Renters And There's Not Enough Apartments. Listen here.

Watch Mitch Siegler on the Alternative Investment Podcast discussing why multifamily remains a resilient sector despite economic turbulence. Hear Mitch’s perspective on value-add multifamily investment strategies and Pathfinder's unique approach. Watch it here.

Share this Article