Charting the Course

The Making of a Pathfinder Acquisition

By Mitch Siegler, Senior Managing Director

Pathfinder acquired Casa Madrid, an 88-unit, value-add apartment property in San Diego County last month. Until now, we had completed 139 acquisitions, so this purchase represents just 0.7% of the properties we’ve acquired since 2006. As such, it’s barely worth a mention. Yet, because this is the first property we’ve acquired since May 2022, it’s worthy of some ink.

Why the Dry Spell?

Casa Madrid is our first multifamily property acquisition in two-and-a-half years – that’s a long dry spell for a firm which has historically acquired a property every couple of months. This extended hiatus, which reflects our disciplined investment approach, was triggered by the 525- basis point (5.25%) rise in interest rates from March 2022 through July 2023. (Interest rates have remained at the July 2023 level since that time.) This rapid rise in interest rates, combined with a dearth of market sellers – created two conditions: negative leverage and a plummeting of transaction activity. We’ll unpack both of those below.

Typically, real estate investors benefit from the use of debt, which has the effect of “leveraging” or amplifying investment returns. Consider this primitive example: A property acquired for $10,000,000, which generates income of $600,000, provides the investor who finances the purchase entirely with equity with a 6% return on equity. Easy math, right? Now, if that investor borrows 60% ($6,000,000) of the purchase price to complement his 40% ($4,000,000) in equity, the return on equity rises to 15.0% (lower, of course, once we factor in the interest expense, which we’ll ignore in this example, which is only for illustration purposes). At a high level, if the investor’s interest rate is below 6%, the use of debt is accretive to investment returns; if the interest rate is above 6%, the debt service cost is dilutive to returns.

Here's the rub. For the past couple of years, the prevailing borrowing (interest) rate has generally exceeded the prevailing capitalization (cap) rates (which are essentially a measure of the price of investment properties). This has made most acquisitions unworkable for Pathfinder and other conservative (read “disciplined”) investors since it created a negative leverage situation. Our Chief Investment Officer characterizes the past couple of years as a “pencils down” underwriting environment (e.g. “fubbedaboutit – no transaction can pencil”). That goes a long way in explaining why the volume of multifamily transactions plummeted about 75% since 2022!

Wither Interest Rates?

Now, short-term interest rates haven’t yet begun their down move – though it appears that this is poised to change. The Federal Reserve meets in mid-September and most Wall Street analysts expect a 25 to 50 basis point reduction in the Federal Funds rate, a key interest rate benchmark. (A basis point is 1/100 of a percentage point.) This will likely be the first of two or three interest rate cuts before the end of 2024 and possibly another three to five rate cuts in 2025 – though the crystal ball becomes rather opaque that far into the future. As rates move down, the acquisition environment becomes more attractive for institutional real estate investors. That should boost values and bring more sellers off the sidelines, leading to increased transaction activity. (The wild card is how many properties will be sold by distressed owners but that’s a story for another day.) We forecast lower interest rates leading to more buying and selling activity for late 2024 and 2025.

Now, short-term interest rates haven’t yet begun their down move – though it appears that this is poised to change. The Federal Reserve meets in mid-September and most Wall Street analysts expect a 25 to 50 basis point reduction in the Federal Funds rate, a key interest rate benchmark. (A basis point is 1/100 of a percentage point.) This will likely be the first of two or three interest rate cuts before the end of 2024 and possibly another three to five rate cuts in 2025 – though the crystal ball becomes rather opaque that far into the future. As rates move down, the acquisition environment becomes more attractive for institutional real estate investors. That should boost values and bring more sellers off the sidelines, leading to increased transaction activity. (The wild card is how many properties will be sold by distressed owners but that’s a story for another day.) We forecast lower interest rates leading to more buying and selling activity for late 2024 and 2025.

Why Casa Madrid?

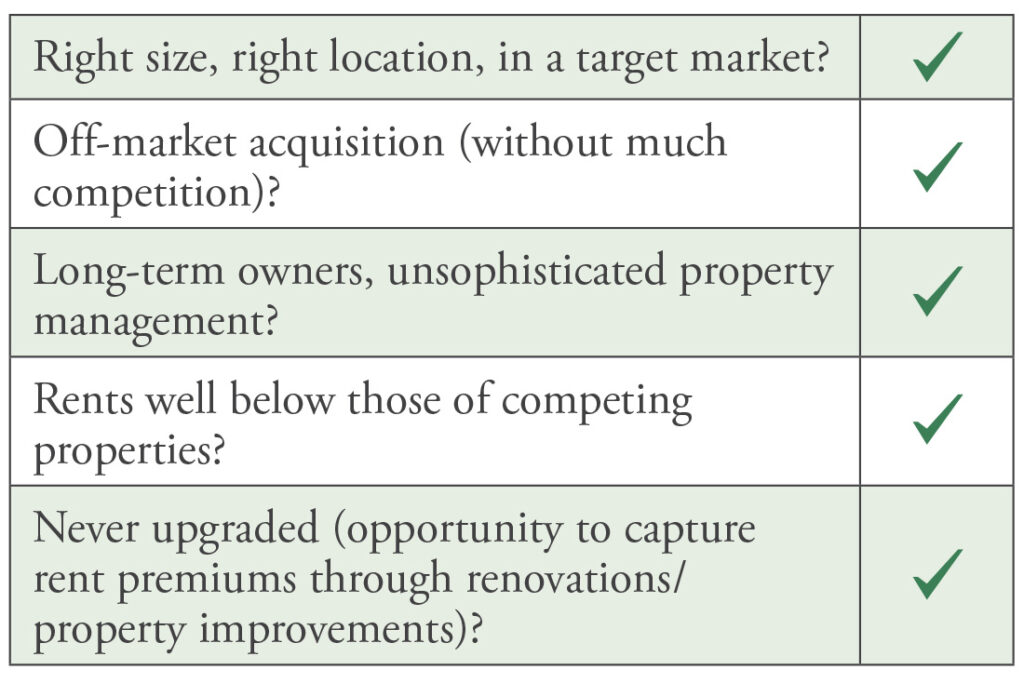

So, how were we able to find opportunity in Casa Madrid, notwithstanding today’s higher interest rates? Well, the property checks quite a few of the boxes we look for when acquiring a multifamily property:

An important intangible: San Diego County is our backyard, and we know the market well. The vacancy rate in the County is low (around 5% in August 2024) and median home prices are high ($998,000 in June 2024) so apartment demand is likely to remain quite high. Supply is constrained as well so that’s unlikely to change anytime soon.

So, we’ve identified a potential acquisition with many strengths, limited weaknesses and substantial opportunities for adding value. We’re just scratching the surface on the many boxes we’ll need to check during the Pathfinder due diligence process and before we can think about closing (Disclaimer: There’s much to consider; this business is not for the faint of heart.)

Our Due Diligence/Closing Checklists (aka Think Twice Before Trying This at Home)

Month in, month out, we receive calls from long-term real estate investors who say something like “I’ve been investing in multifamily real estate for 42 years, but it’s just become so darned complicated, and there’s just so much nitty-gritty work involved…you Pathfinder guys are the pros, I’m just going to invest in your funds and let you do all the work.”

And they’re not wrong. We have deep relationships which allow us to access these opportunities. Our highly skilled team focuses entirely on managing, operating and adding value to apartment properties. We have expertise in property design, construction, finishes and more, enabling us to match the fit and finish of the properties with the wants and desires of tenants in that submarket. We’ve learned which property features and benefits are most valued by tenants and have the skills to install washers/dryers and package lockers, build carports, add amenities like dog parks and dog wash stations, upgrade clubhouses, gyms and pool areas, construct accessory dwelling units (ADU’s) and more.

And they’re not wrong. We have deep relationships which allow us to access these opportunities. Our highly skilled team focuses entirely on managing, operating and adding value to apartment properties. We have expertise in property design, construction, finishes and more, enabling us to match the fit and finish of the properties with the wants and desires of tenants in that submarket. We’ve learned which property features and benefits are most valued by tenants and have the skills to install washers/dryers and package lockers, build carports, add amenities like dog parks and dog wash stations, upgrade clubhouses, gyms and pool areas, construct accessory dwelling units (ADU’s) and more.

We also have extensive lender relationships (critical at times like these when lenders are pickier and choosier than ever). And we have a great team of lawyers, accountants, tax and insurance specialists and third-party consultants – title and zoning experts, property condition inspectors and more – who help us navigate the pitfalls and keep headaches to a minimum. (Disclosure: Some headaches do remain, we simply can’t eliminate them all, unfortunately.)

Getting Across the Finish Line

There are more than 75 items on the 2024 version of the Pathfinder “Due Diligence Checklist”. We’re checking entitlements, building permits and zoning regulations, reviewing the title report and verifying the certificates of occupancy. We’re searching for tax liens, prior insurance claims and, prior litigation, verifying square footage, analyzing parking and verifying that necessary permits (pool/spa, elevator, etc.) are in place.

Firewalling the property – Since we’re laser-focused on building in protections for our investors, we own each property in a single-purpose entity, which is firewalled from every other property in a fund. That means we need to form an entity, obtain an employer identification number, draft an Operating Agreement and a dozen things only a lawyer could love.

Building a Property Pro Forma – Meanwhile, our investment analysis team builds a comprehensive pro forma to model the property financial performance five to ten years into the future. Plenty of ingredients go into the pro forma cake, starting with historical financial statements, layering in the current rent roll and general ledger, utility, property tax and insurance costs. We check everything twice, obtain new insurance quotes and forecast future property taxes. The underwriting team also commissions a competitive market survey to understand current and potential rent levels – a key consideration in building a long-term pro forma.

Creating a Capital Expense Budget – Of course, we’re looking to add value to the property, which means we’re renovating kitchens and bathrooms, updating common areas, upgrading landscaping and signage and much more. To prepare the capital budget, we start with property condition reports (roofs, furnaces, drains, piping and more), You get the idea.

Leaving No Stone Unturned – Leaving nothing to chance, our team also audits every lease, brings in the termite inspector, obtains necessary third-party reports like environmental conditions, confirms that the property is not in a flood zone and much more.

But That’s Not All… – We acquired Casa Madrid using equity from our newest opportunity fund (Pathfinder Multifamily Opportunity Fund IX – we’re still accepting commitments, by the way) and a property-specific sidecar fund (that’s closed). Having a sidecar fund means we also need to prepare a separate Investment Summary and draft a Partnership Agreement, Private Placement Memorandum and Subscription Agreement. The lawyers really seem to love this stuff and when they’re finished with these, they get to jump to the preparation of the Federal and State securities filings (one of our favorite parts – not).

(Thanks for staying with us; we’re almost there.) Now, we still need to finalize the loan documents, including the Loan Agreement, Promissory Note, Deed of Trust, Guaranties and Environmental Indemnity Agreements, Assignment of Management Agreements, Ancillary Loan Documents (lender-prepared consents, UCC’s, W-9s) and more.

You think I’m kidding but this is basically a cursory summary of the process! To repeat, it’s not for the faint of heart and there are plenty of ways to stumble if you’re not experienced and highly detail oriented. When we acquire a property, we create a battle plan and assemble a great team – both staff and advisors – to execute the plan. We know the drill. We’ve had 139 opportunities to practice. Make that 140.

Mitch Siegler is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Mitch founded and served as CEO of several companies and was a partner with an investment banking and venture capital firm. He can be reached at msiegler@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

Multifamily Opportunity / Value-Add Fund

CHARTING THE COURSE

The Making of a Pathfinder Acquisition

FINDING YOUR PATH

Real Estate Quiz

GUEST FEATURE

Real Estate Investing Lessons Learned from a College Student, Ultramarathoner and Mike Tyson

ZEITGEIST

News Highlights

TRAILBLAZING

Internet as an Amenity

NOTABLES AND QUOTABLES

Patience