Guest Feature

Putting Higher Interest Rates into Perspective

By Scot Eisendrath, Managing Director

I’m guilty. Over the past few years, I’ve been following interest rates pretty closely. Of course, being financially minded and in real estate I’ve always paid attention to where rates are and where the pundits think they may be headed, but if you ask me today where the ten-year treasury rate is, I will know within a few basis points.

I’m guilty. Over the past few years, I’ve been following interest rates pretty closely. Of course, being financially minded and in real estate I’ve always paid attention to where rates are and where the pundits think they may be headed, but if you ask me today where the ten-year treasury rate is, I will know within a few basis points.

I wouldn’t call it an obsession, but I’ve gotten into the habit of seeing where the ten-year treasury yield to maturity is each morning and then again at the end of the trading day. Okay, maybe once more before going to bed I’ll take a quick look at the after-hours quotes to get a feel for where treasuries will open the next day – who doesn’t like to get a head start on tomorrow! It’s been an interesting run and there has been plenty of excitement and volatility.

Why have I paid such close attention to interest rates? We’ve been busy at Pathfinder placing financing on new acquisitions, refinancing some properties, and selling others. Our buyers are dependent on the debt markets and cheaper debt for them translates to higher values for our investors. It’s been a great time for multifamily investors to take advantage of historically low long-term rates. In fact, our financings during the past year have featured seven- to ten-year loans at fixed rates in the 2.5% to 3.0% range. Nothing to complain about there!

While I’m more than a casual observer, the media and financial markets are downright obsessed with movements in interest rates. I realize that rates have a significant impact on the general economy and directly impact many things – like the general cost of funds, the discount rate underlying the net present value of future corporate earnings, fixed incomes for pensioners and borrowing rates for real estate purchases, credit card balances, corporate bonds and more. But when rates move ten or twenty basis points in a week at these relatively low levels, it’s really not the end of the world, and needs to be put in perspective.

While I’m more than a casual observer, the media and financial markets are downright obsessed with movements in interest rates. I realize that rates have a significant impact on the general economy and directly impact many things – like the general cost of funds, the discount rate underlying the net present value of future corporate earnings, fixed incomes for pensioners and borrowing rates for real estate purchases, credit card balances, corporate bonds and more. But when rates move ten or twenty basis points in a week at these relatively low levels, it’s really not the end of the world, and needs to be put in perspective.

The NASDAQ, comprised primarily of high-flying technology stocks, dropped nearly 6% in September, primarily attributable to rising interest rates; the benchmark ten-year treasury rate rose during the month from 1.31% to 1.54%, a 23-basis point (18%) increase. I was taught that higher interest rates normally indicate that the economy is heating up (unless, heaven forbid, we get hit with Japan-like stagflation). Who wouldn’t be happy with an improving economic picture?

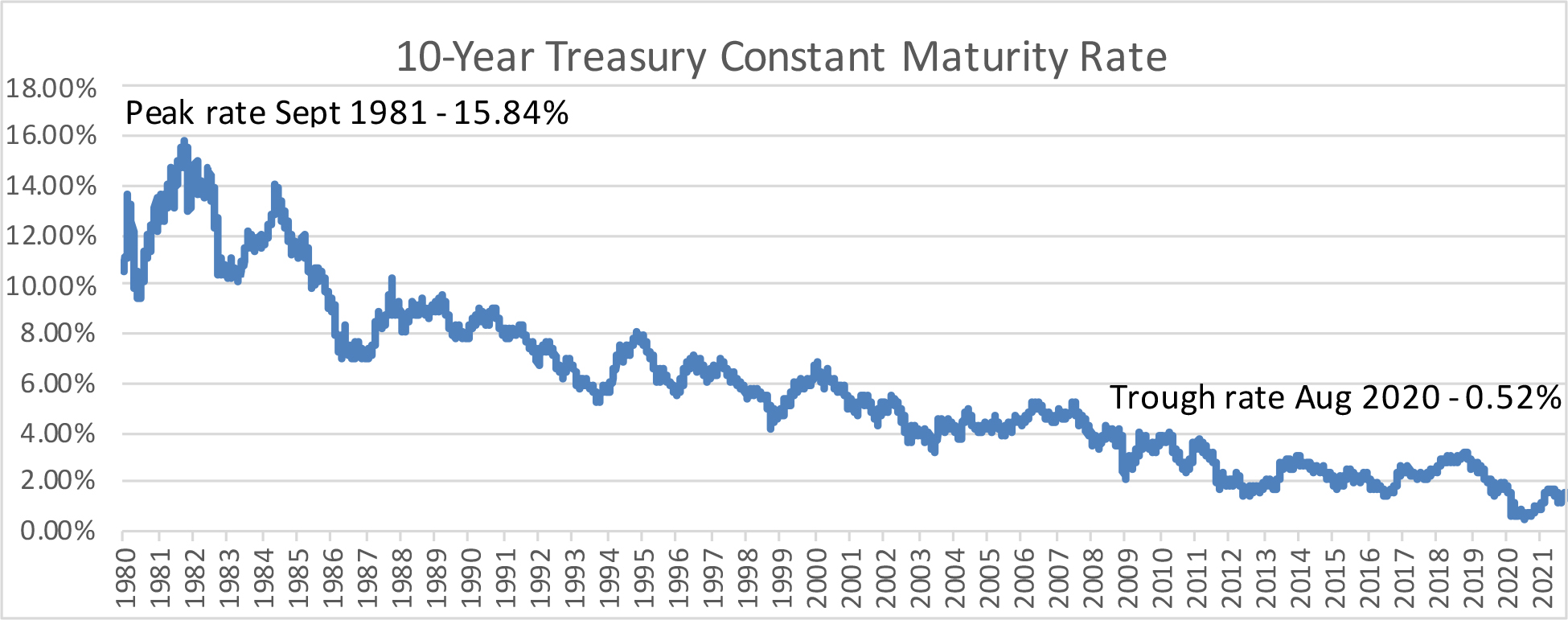

Enlarging our scope, consider that the ten-year treasury rate moved from 0.93% last December to about 1.60% earlier this month. Pretty big move, more than 70%. But let’s put that into perspective. We’ve had a 40-year bull run in the bond markets. The ten-year treasury rate peaked in September 1981 at 15.84% (see graph below) so it’s down about 90% over the past four decades. In the four years from 1977 to 1981, the yield on long-term corporate bonds nearly doubled – from 7.92% to 15.49%. Now that’s a big move, fast! I’ve heard the horror stories about 18% mortgage rates, and in fact, my first mortgage in the mid-1990’s was in the 8% range.

I’m concerned about increasing interest rates and their effect on the economy and asset values, but at some point, rates need to rise, and I think gradual increases would be healthy for the financial markets. Sure, our borrowing costs will rise, but if we’re still borrowing in the 3% to 4% range, that’s fantastic, and if rates have risen to that level, it likely means the country is prospering and our economy is humming along.

In the meantime, my investment advice is to be cautious about owning bonds/fixed income securities as rate increases are likely, which wouldn’t be good for the value of these securities. And, on the other side of the ledger, consider taking advantage of these long-term, historically low rates by locking them in for the long haul. We may never see rates this low again.

Scot Eisendrath is Managing Director of Pathfinder Partners, LLC. He is actively involved with the firm’s financial analysis and underwriting and has spent 20 years in the commercial real estate industry with leading firms. He can be reached at seisendrath@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER PARTNERS INCOME FUND, L.P.

A Stablized Multifamily Fund

CHARTING THE COURSE

Maybe It’s Time to Rethink a Few Things

FINDING YOUR PATH

The Customer Service Conundrum

GUEST FEATURE

Putting Higher Interest Rates into Perspective

ZEITGEIST

Sign of the Times

TRAILBLAZING

Red Hawk, Castle Rock (Denver), CO

NOTABLES AND QUOTABLES

Collaboration